HIGHLIGHTS

Chances are, if you're a gold investor, you've got some money invested in companies with projects in Nevada. And if you don't, we'll be honest: you should.

Whether you're just curious about top Nevada gold mining companies or looking for the best places to invest, we're here to help you master the markets and generate bigger returns.

To get you there, we dug into Nevada mining data, providing you with our top picks to profit from one of the most gold-packed districts on the globe.

Nevada, though officially known as the "Silver State," is one of the world's biggest sources of gold. In 2019, the state accounted for as much as 84% of US gold production, and 35% of production across all of North America. Take Nevada out of the United States, and it becomes the fifth largest gold producer on the planet, topped only by Canada, Russian, Australia, and China.

And capital follows production. From January through November 2020, Nevada was among the most-financed gold districts in the world, with $369.12 million raised. In North America, it trails only behind Ontario, Mexico, Quebec, and British Columbia.

Today, the region is dominated by many of the biggest players in the field, predominately through an array of large open-pit heap leach mines. Newmont Corp. (TSX: NGT) pioneered these mines when it sparked the Nevada gold rush back in 1965 with its Carlin mine, and since then, gold frenzy has taken hold of the region.

In 2019, the company partnered with Barrick Gold Corp. (TSX: ABX) to create Nevada Mines LLC, the largest gold production complex on Earth. Kinross Gold Corp. (TSX: K) extracts hundreds of thousands of ounces annually from its Round Mountain and Bald Mountain mines currently being explored. SSR Mining Inc. (TSX: SSRM) rounds out the large producers with the Marigold Mine, while smaller producers like Hecla Mining Co. (NYSE: HL), Coeur Mining Inc. (NYSE: CDE), and Sprott Mining Inc. (private) pull ounces from less prominent mines scattered throughout the state.

But while massive gold producers are sitting on some of the strongest deposits in Nevada, an active junior mining exploration industry continues to uncover significant deposits in the region.

And while many of the world-class gold mining companies are priced well out of the range of enormous, life-changing returns, there's plenty of upside awaiting savvy value investors.

To help you profit from Nevada's tremendous gold mining industry amid the 2020 bull run, we've written this article to give you a detailed snapshot of the landscape in the region.

But first, a quick history lesson.

Gold Mining in Nevada: A Brief History

Today's top Nevada gold mining companies trace their lineage back to the 1840s, with the now-famous flood of prospectors dubbed the "49ers" camping and panning their way across the arid deserts of Nevada to reach gold-rich California. By the end of a decade of miners travelling east to west, they had stumbled upon the Comstock Lode outside Virginia City, Nevada, the first major silver find in the United States, kicking off a silver rush in the region.

Still, it wasn't until Newmont began exploring Nevada that gold took off in the state. Though gold exploration was out of favour in the US in the 1950s, technological advances in an extremely competitive and innovative base metals industry was steadily enabling the mining of finer and finer grades of copper. Newmont had been involved in the development of these advancements in base metals, and executives at the company began to wonder whether this strategy could be applied to precious metals as well.

The company sampled a wide band of microscopic gold from a bulldozed trench in 1961 along what would be later known as the Carlin Trend, a industry-famous belt of huge gold deposits characterized by low-grade "invisible gold." Following further exploration in the area, Newmont opened the Carlin mine in 1965. By 2016, the industry had extracted more than 88.2 million ounces of gold from the Carlin Trend, cementing its status as one of the most productive mining jurisdictions in the world.

In the past 10 years, mining capital has ebbed and flowed, partly in line with the fluctuating price of gold, as well as the financing activities of some of the biggest players. In the chart below, we see a peak in 2012, the year after the yellow metal hit its previous all-time peak of US$1,837 per ounce. In 2020, gold handily broke that record, but we haven't yet seen investing capital quite catch up.

4 Picks from the Top-Performing Nevada Gold Financings of 2020

As you can see above, Nevada gold mining companies have raised $369.12 million through financings from January through the end of October.

Retail investors hoping to profit from top Nevada gold mining companies can certainly do so through ordinary day-to-day investing. However, as always, the best way to generate truly life-changing wealth from gold miners is through private placements.

There are three reasons for this:

- Bigger positions: private placements allow you to secure a many more shares in your company of choice

- Lower prices: shares or special units offered in a private placement are often sold at a significant discount to retail common shares

- Warrants to multiply your return: financings frequently have warrants attached that allow holders to purchase additional shares at a fixed price for 2-5 years.

Each of these factors lead to significantly larger returns if and when a stock takes off. Combine private placements with junior miners, which already have incredible breakout potential, and you have a recipe for some genuinely transformative gains.

However, private placements are a high-risk (and high reward) proposition, and they sometimes appear with only a brief window to get involved. To help you comb through some of the most promising junior miners, we've dug through our comprehensive financing database and generated a list of some of the most lucrative private placements this year, organized by return on equity.

We've excluded stocks currently trading under 30 cents per share and those trading at extremely low volumes, and focused only on financings arranged since April 1 to avoid any pre-COVID-19 skewing of the data. If a financing included warrants, we've added that information in too so you can see exactly how much an investment would've been worth if you had participated at the time. The share price of each stock was taken at the close of market on Dec. 2.

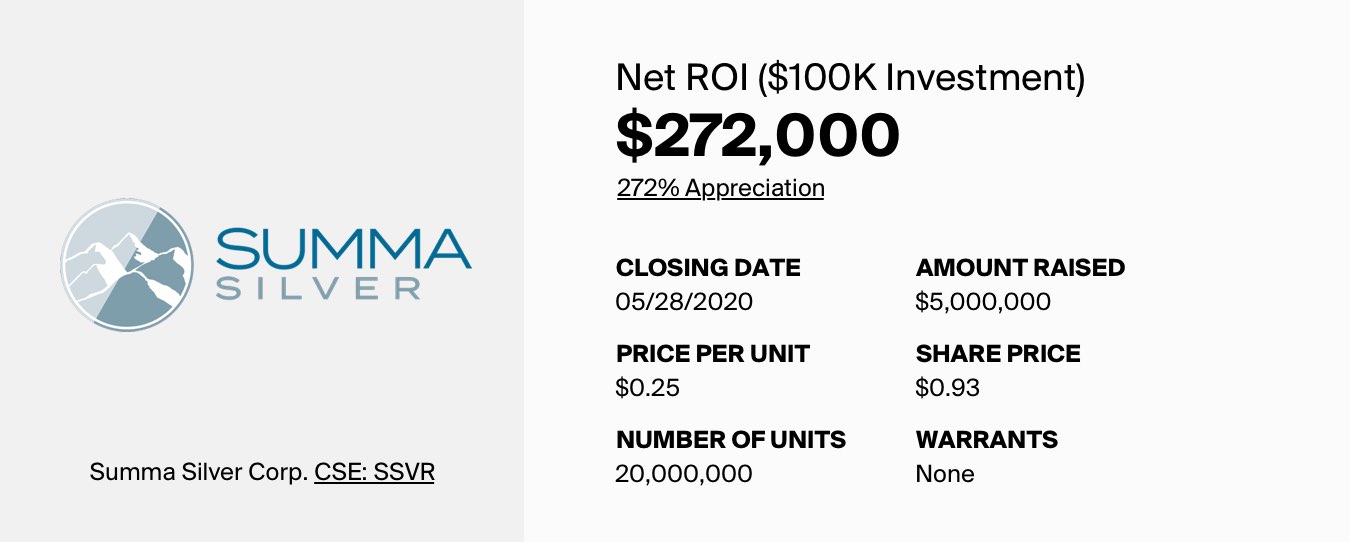

1. Summa Silver Corp. (CSE: SSVR)

Though its name says silver, Summa Silver Corp. (CSE: SSVR) is a junior miner exploring for both gold and silver at its flagship Hughes property in Tonopah, Nevada.

The company closed a $5 million private placement back in May, selling 20 million units at 25 cents each. No warrants were included in the deal as a sweetener, but had you invested $100,000 in the offering, you could have sold your position for a net profit of $272,000 on Dec. 2.

Notably, the deal was subscribed significantly by Canadian billionaire investor Eric Sprott, a prominent kingmaker in the mining space who has been especially active since the price of gold carved out new highs in the summer of 2020

Summa's Hughes property is located in close proximity to the historic Belmont mine, which was one of the largest producers of silver in the 1910s. The company hopes to re-assess the project and turn it into a lucrative prospect.

From its ongoing 7,500-metre drill program, the company recently reported a number of high-grade results, including 1,762 grams of silver per tonne (g/t Ag) and 19.99 grams of gold per tonne (g/t Au) over 2.5 metres, 1,870 g/t and 5.53 g/t Au over 0.8 metres, and 2,370 g/t Ag and 22.6 g/t Au over 0.2 metres.

These assays may be from narrow intervals, but they're certainly encouraging, making Summa Silver one that needs to be on every junior mining investor's radar.

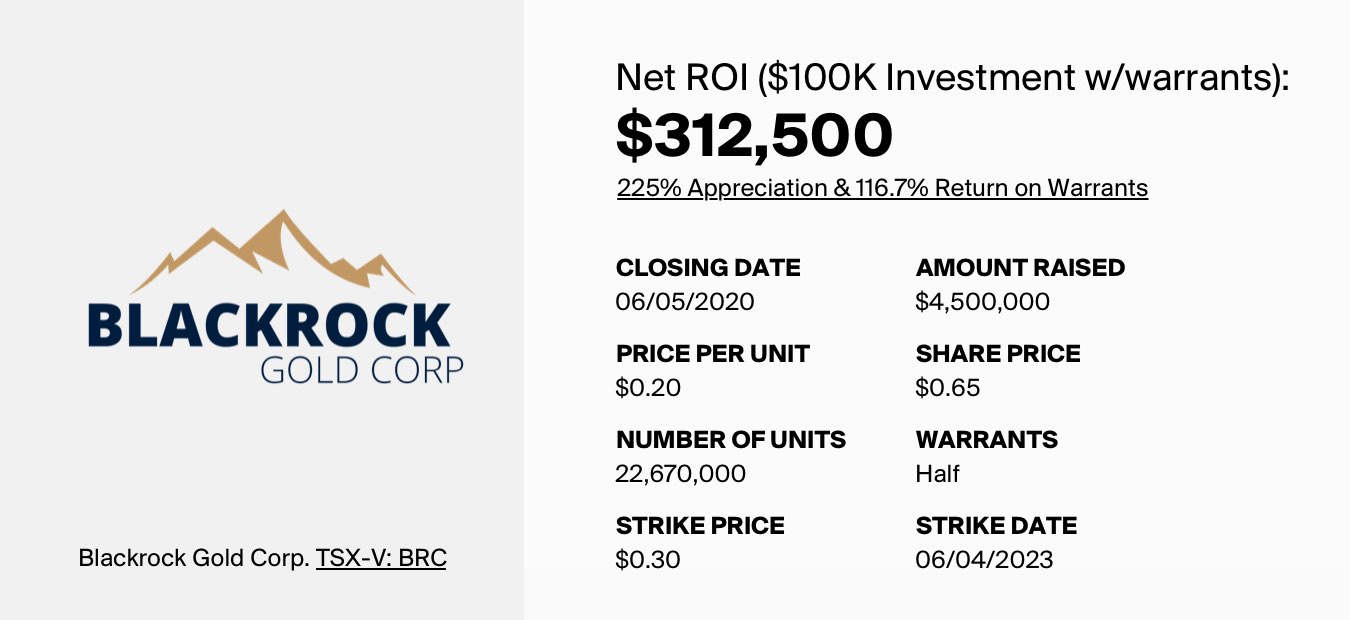

2. Blackrock Gold Corp. (TSX-V: BRC)

Blackrock Gold, another gold-silver miner exploring the Tonopah district in Nevada, closed a $4.5 million private placement back in June.

The company issued 22.67 million special units at 20 cents each. Each unit included a common share and one half of a warrant, with full warrants exercisable at 30 cents until June 4, 2023.

Had you invested $100,000 in the deal, you could already sell your 500,000 shares for $325,000—a net return of $225,000. And if you exercised your 250,000 warrants today, that'd bring in an additional $87,500, bringing the total to a whopping net $312,500 in your pocket.

We wrote about Blackrock in July, when its shares doubled in value overnight following bonanza-grade drill results at its Tonopah West project. At that time, the company reported assays including 11.52 g/t Au and 1,046 g/t Ag over 3.04 metres.

Since then, Blackrock has secured another private placement—subscribed in part by Eric Sprott—and announced another round of solid results at Tonopah West, including 18.67 g/t Au and 1,736.73 g/t Ag over 1.5 metres.

With shares up 75 cents since the beginning of April, and trade volume in the several hundred thousands every day, Blackrock is another must-watch for 2020.

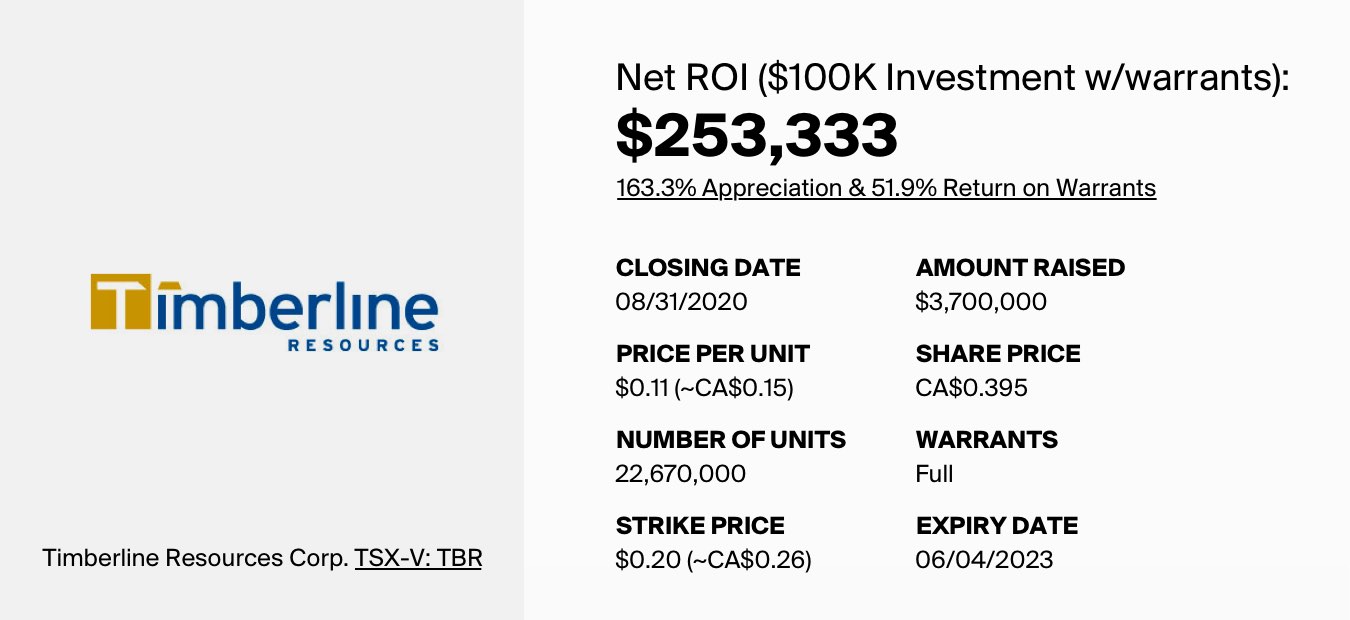

3. Timberline Resources Corp. (TSX-V: TBR)

Idaho-based Nevada junior gold explorer Timberline Resources Corp. (TSX-V: TBR) arranged a US$3.7 million (~CA$4.9 million) private placement in August, trading shares at a significant discount to the share price at the time of the deal.

The company issued 33.64 million units at US$0.11 per unit (~CA$0.15), 5 cents CAD below its share price when it initially announced the deal. What's more, each unit included a full warrant, exercisable at US$0.20 until Aug. 15, 2023.

By the time the deal closed, shares of Timberline had climbed 9 cents, giving investors an encouraging gain right away. Again, if you had invested CA$100,000 in the deal—and units were out of the obligatory hold period associated with private placements—today you could sell for CA$263,333, a net profit of $163,3333. With warrants included, you could add another $90,000, for a total net return of $253,333.

Timberline is currently focused on drilling its Eureka property, particularly the Lookout Mountain project, located along Nevada's well-known Battle Mountain gold trend. The company began drilling in mid-September, and we're still awaiting results.

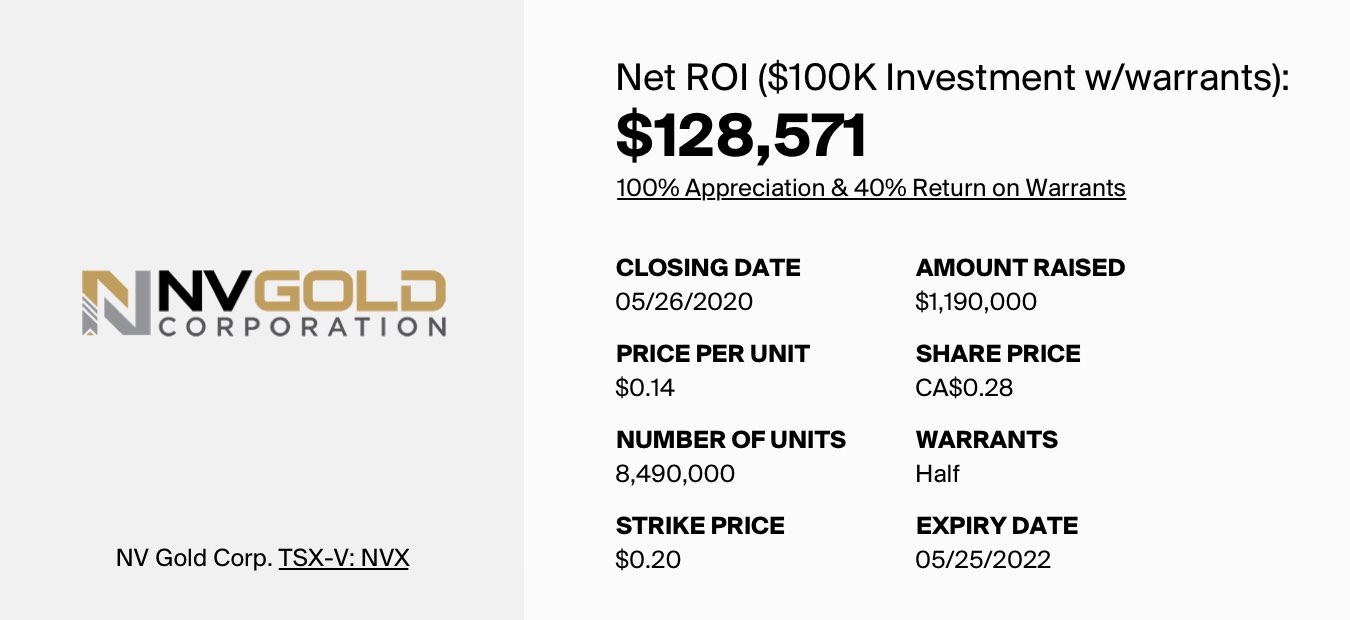

4. NV Gold Corp. (TSX-V: NVX)

NV Gold Corp. (TSX-V: NVX) closed a smaller, $1.19 million private placement in May, aiming to advance its Slumber and Sandy projects, both in Nevada.

The company issued 8.49 million special units at 14 cents each, with each consisting of a common share and a half-warrant, with full warrants exercisable at 20 cents until May 25, 2022.

In NV's case, had you invested $100,000 in the deal, you could now cash out for a net return of $128,571, including the exercise of 357,000 warrants.

NV Gold recently announced that it received the necessary permits to begin a 1,500-metre drill program at the Sandy project in Lyon County Nevada, following a property-wide geophysical survey to pinpoint targets for exploration. It also reported the completion of a geophysical survey of the Slumber project, and is awaiting permits to begin drilling there.

The Top 3 Nevada Gold Mining Companies to Watch

Though the majority of Nevada's rich mining territory is dominated by the big dogs, there remain numerous underexplored pockets awaiting high-grade discoveries from up-and-comers.

Along the wide gold belts crossing the state, all it takes is a single noteworthy drill hole for a junior mining company to gain traction. From there, it's easy to see how a junior miner can quickly become an acquisition target for a world-class firm like Barrick Gold Corp. (TSX: ABX), Kinross Gold Corp. (TSX: K), or SSR Mining Inc. (TSX: SSRM), leading to tremendous share appreciation and enormous returns for investors.

But as always, not all junior mining companies are created equal. It takes a keen eye to separate the wheat from the chaff and determine which are genuinely worth your attention. To help you in your search, we've compiled this list of three Nevada gold companies that have been making serious moves this year.

1. Bullfrog Gold Corp. (CSE: BFG; OTCQB: BFGC)

Bullfrog Gold Corp. (CSE: BFG), a junior gold exploration company based out of Colorado, is one early-stage miner that should definitely be on your radar in the coming months.

Bullfrog Gold is focused on the Bullfrog Gold project, located about 125 miles northwest of Las Vegas. The property is near the historical Bullfrog Mine, an operation from which Barrick extracted 2.3 million ounces of gold between 1989 and 1999 before shuttering.

However, Bullfrog is confident that there's still significant value to be unlocked on the property. Modern exploration strategies empower companies to pinpoint previously overlooked mineralization, while contemporary heap leach technologies allow companies to pull significantly more gold from tonnes and tonnes of ore than they could in the past. To top it off, the price of gold recently cracked an all-time high, making projects like Bullfrog's significantly more attractive, with a much stronger potential to become economic and generate gains for investors. This remains true even amid gold's price contraction, as experts agree the fundamentals still support a strong outlook for the yellow metal in 2021.

Prior to September 2020, Bullfrog was certainly interesting, but not necessarily a "must-watch" in our book, rising fairly steadily but without any flashy news to report. The real banner story for Bullfrog came on Sept. 8, when it announced that Barrick was re-entering the picture through a new agreement with the company.

The deal includes the sale of Barrick's Bullfrog Mine claims, 1,500 prime acres right next to the Bullfrog Gold project. In return, Bullfrog issued 54.6 million units at 20 cents each to Barrick, with each unit including a common share and a warrant exercisable at $0.30 for four years.

110 million more units were issued under the same terms to Augusta Group, a management group focused on the mining sector with over $4.5 billion in exit transactions under its belt since 2011. Following the transaction Barrick owns 15.9% of Bullfrog's total outstanding shares, while Augusta owns 31.9%.

Also as part of the deal, Augusta reshuffled Bullfrog's board and replaced CEO David Beling with Maryse Bélanger as president, CEO, and director of the company. In a sector where the people behind a company matter as much as its projects, the addition of Bélanger is encouraging indeed. In her recent tenure at Atlantic Gold, where she served as COO and director, she helped guide the company as it took its Touquoy Mine in Nova Scotia from construction to full production, leading to a $722 million takeover by the Australian St. Barbara Ltd. (ASX: SBM). Prior to that, she worked as a senior executive at Goldcorp (now Newmont), and as the director of technical services for Kinross' Brazil and Chile arms.

The announcement of the deal saw shares of Bullfrog jump 75% in a single day, and it has lost little of that ground since.

A 2017 resource estimate filed by engineering firm Tetra Tech Inc. pegged the Bullfrog deposit deposit with 525,400 ounces of gold measured and indicated at an average grade of 0.91 grams of gold per tonne of ore (g/t Au), with another 110,700 ounces of gold inferred—a solid foundation for further exploration, to say the least.

And in an exploration update the company released in July, the company included 25 drill holes from the project, with the highest-grade result clocking in at 8 metres of 3.23 g/t Au. No big surprises or staggeringly high-grade assays in the drill results—they align pretty closely with the resource estimate—but they may support Bullfrog's hope to develop an open-pit heap leach mine similar to those scattered across Nevada.

Clearly, Barrick and Augusta group believe in Bullfrog's prospects, which, when coupled with the newly-enlarged Bullfrog project and the company's stellar team, make us keen to see where it will go next.

2. Eclipse Gold Mining Corp. (TSX-V: EGLD; OTC: EGLPF)

Eclipse Gold Mining Corp. (TSX-V: EGLD; OTC: EGLPF) may be a new face among junior miners, but don't let that fool you—this is one stock with serious potential.

Eclipse Gold began trading on the TSX-V back in February and, after a brief nosedove during COVID-19, quickly gained ground, propelled by positive buzz and its promising Hercules project 25 miles south of Reno, Nevada. But it's Eclipse's team in particular that pushes the company onto our watchlist.

Eclipse is led by its Director, President, and CEO Michael G. Allen, a geologist who previously served as the CEO of Northern Empire Resources. There, he was instrumental in the acquisition and development of the Sterling Gold project in Nevada, which led to the company being taken out by Coeur Mining Inc. (NYSE: CDE) for $117 million in 2018.

Marcel de Groot, Eclipse's chairman, is a financier who co-founded Pathway Capital, a strategic investment firm which provides support to early-stage mining companies, in 2004. The organization has raised over $800 million in equity and has been involved in more than $900 million in M&A transactions over the years. Pathway also worked on Peru Copper, which was bought out for $850 million in 2007 by Chinaclo. De Groot himself has been involved in several successful companies, including a stint on the board of Underworld Resources, which was eventually acquired by Kinross for $138 million.

Meanwhile, Douglas J. Hirst, a director at Eclipse, was the founder of Newmarket Gold, which sold to Kirkland Lake Gold Ltd. (TSX: KL) for $1 billion in 2016. Before that, he founded International Royalty, acquired by Royal Gold for $700 million in 2010.

Between just those three members of Eclipse management is a staggering number of past exits. Such a serially successful team always warrants attention.

The company's Hercules project is a district-scale property housing four near-surface gold systems, not far from infrastructure in Reno and Carson City and with three nearby mines. The project is located on Nevada's Walker Lane trend, home to the incredible Comstock Lode which kicked off the original silver rush in the state in the 1840s. Eclipse began a 6,750-metre phase two drill program on the project in September, testing a new target as a potential feeder for the larger mineral system. Results from the earlier drill program are encouraging, with grades including a wide 89.92-metre interval of 0.81 g/t AuEq.

As always, drill results make or break a junior miner. With more assays on the way, it's only a matter of time for Eclipse.

3. Gold Standard Ventures Corp. (TSX: GSV; NYSE AMERICAN: GSV)

Gold Standard Ventures Corp. (TSX: GSV; NYSE AMERICAN: GSV) is another Nevada miner with an excellent team and a portfolio of buzzworthy projects located on the fabled Carlin Trend and the Battle Mountain Trend, two of the most historically productive gold belts in the country. With a market cap of over $277 million, Gold Standard is a bit farther along than the other companies in this list.

The company's flagship project is the Railroad-Pinion project, an intermediate-stage 21,000-hectare property 15 miles south of Carlin, Nevada. The project hosts a number of strong deposits, including: Pinion, which hosts a measured and indicated resource of 544,000 ounces of gold; Dark Star, with 921,000 ounces of gold measured and indicated; North Bullion, a smaller deposit home to an estimated 90,100 ounces of gold; and the Jasperoid Wash, which contains an estimated 111,000 ounces of gold measured and indicated.

Gold Standard announced a phase 1 development plan for South Railroad in August, with plans to drill 20,410 metres on the property across three drill rigs, with the aim of expanding the resources at Pinion and Dark Star and advancing a new feasibility study due in Q2 2021. The first results from that program are positive, with grades including 64 metres of 0.81 g/t Au—the kind of mid-grade wide intervals commonly associated with the Carlin Trend.

The company also recently submitted its plan of operations to Nevada's Bureau of Land Management, including its intent to build the South Railroad open pit mine, a move that kicks the all-important permitting process into motion.

Gold Standard's is led by President, CEO, Director, and Co-Founder Jonathan Awde, a financier who's guided the company from a $23 million market cap in 2010 to its current nine-digit value.

Then there's Bruce McLeod, a Director of the company and a mining engineer who was a director of Kaminak when it was picked up by Goldcorp for $520 in 2016. He also currently serves as the President and CEO of Sabina Gold & Silver Corp. (TSX: SBB), a mining company with a market cap of over $800 million.

With a portfolio of proven deposits and an experienced team, the only possible downside to Gold Standard is that, as an mid-stage company, some of its value is already baked-in to its stock price. However, if the company is able to create a producing open-pit mine on the Carlin Trend, there's still a huge amount of room for its shares to ascend.

Nevada constantly proves that it pays to pay attention to jurisdictions when investing in mining companies. With mining-friendly policies, abundant infrastructure, and some of the most attractive deposits in North America, Nevada must absolutely be on the radar of anyone looking to profit from the booming gold market.