The Uranium Report 2025

From Market Mood to Momentum: The Story Unfolding

From Market Mood to Momentum: The Story Unfolding

The global energy landscape is undergoing significant shifts, with nuclear energy increasingly positioned as the central pillar in the global strategy to meet the growing electricity demand.

Excitement for the resurgence of nuclear energy was palpable at CERAWeek, the premier energy conference held in Houston, Texas. Thought leaders, policymakers, and energy executives gathered to discuss the future of the global energy system with a focus on energy security and the need to meet growing energy demand. The electrification of industry and the artificial intelligence (“AI”) boom received significant airtime amongst energy executives as the key drivers to the growth in electricity.

The rise of AI, particularly generative AI, is expected to significantly increase electricity demand in the United States.

Data centers are expected to consume a substantial portion of the nation's power by 2030, potentially doubling or even tripling their current electricity consumption.

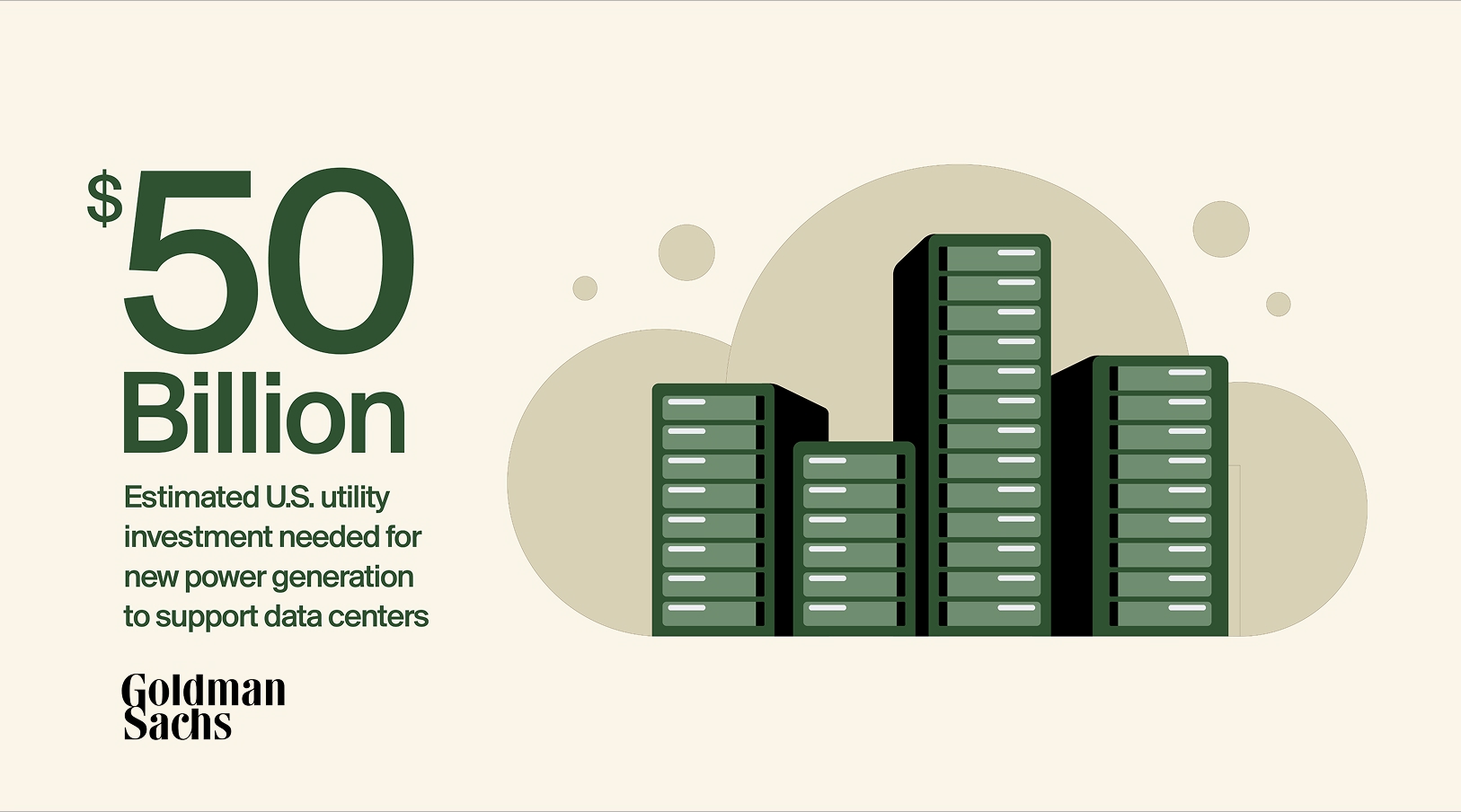

Goldman Sachs, a leading American financial institution, estimates that by 2030, data centers could consume a much larger share of the U.S.'s electricity generation, potentially reaching 8-12%, up from 3-4% today.[1]

Goldman further estimates that U.S. utilities will need to invest around $50 billion in new generation capacity to support data centers alone. A study from the Electric Power Research Institute predicts that data center electricity demand could grow by as much as 166% from 2023 levels by 2030, demonstrating the high-case possibilities for AI-fueled energy consumption.[2]

While anticipated energy demand from data centers is astonishing, it represents a small fraction of anticipated total electricity demand growth. To date, less than a quarter of the world’s energy comes from the grid. However, as heavy industries, such as steel and cement, aim to curb their carbon emissions, they are increasingly looking towards grid electricity as a means to reduce their reliance on fossil fuels. As such, electricity’s share of total energy consumption is projected to more than double, increasing from 20% today up to 50% by 2050.[3]

Reliable, Clean and Abundant Power

The growing need for reliable and abundant energy comes at a time of geopolitical uncertainty, growing greenhouse gas emissions and rising energy costs. The need for affordable, reliable and carbon-free energy has magnified the proven attributes of nuclear energy. Offering abundant, reliable 24-7 power with minimal carbon emissions, nuclear energy avoids the challenges of intermittency created by wind and solar, while offering stable, emissions-free power.

It is no surprise then that at CERAWeek, a conference that has traditionally been dominated by oil and gas, has seen nuclear energy take a prominent role.

U.S. Energy Secretary, Chris Wright, opened CERAWeek with a keynote address that reconfirmed the Trump Administrations commitment to rebuilding the nuclear energy industry in the United States.

This unwavering political support was soon complemented by unprecedented cross-industry backing when a group of large energy users including the big tech companies of Amazon, Google and Meta signed a pledge supporting the goal of at least tripling global nuclear capacity by 2050. The pledge, which builds on the commitment from 31+ nations, 140+ industry players and 14 large financial institutions, marks the first time major businesses beyond the nuclear sector have come together to publicly back the concerted expansion of nuclear power to meet increasing global energy demand.[4]

This pledge comes at a time of significant momentum for the nuclear energy sector. Nearly every big tech company has invested in the energy source, including Meta who is investing in 4 GW of new nuclear power to support AI[5] and Microsoft, who announced a 20-year power purchase agreement with Constellation Energy to restart the Pennsylvania’s Three Mile Island nuclear power generation facility.[6]

We are working to launch the long-awaited American nuclear renaissance, fission and fusion. We want more reliable, affordable, secure energy.” - U.S. Energy Secretary, Chris Wright[7]

Uranium Fundamentals

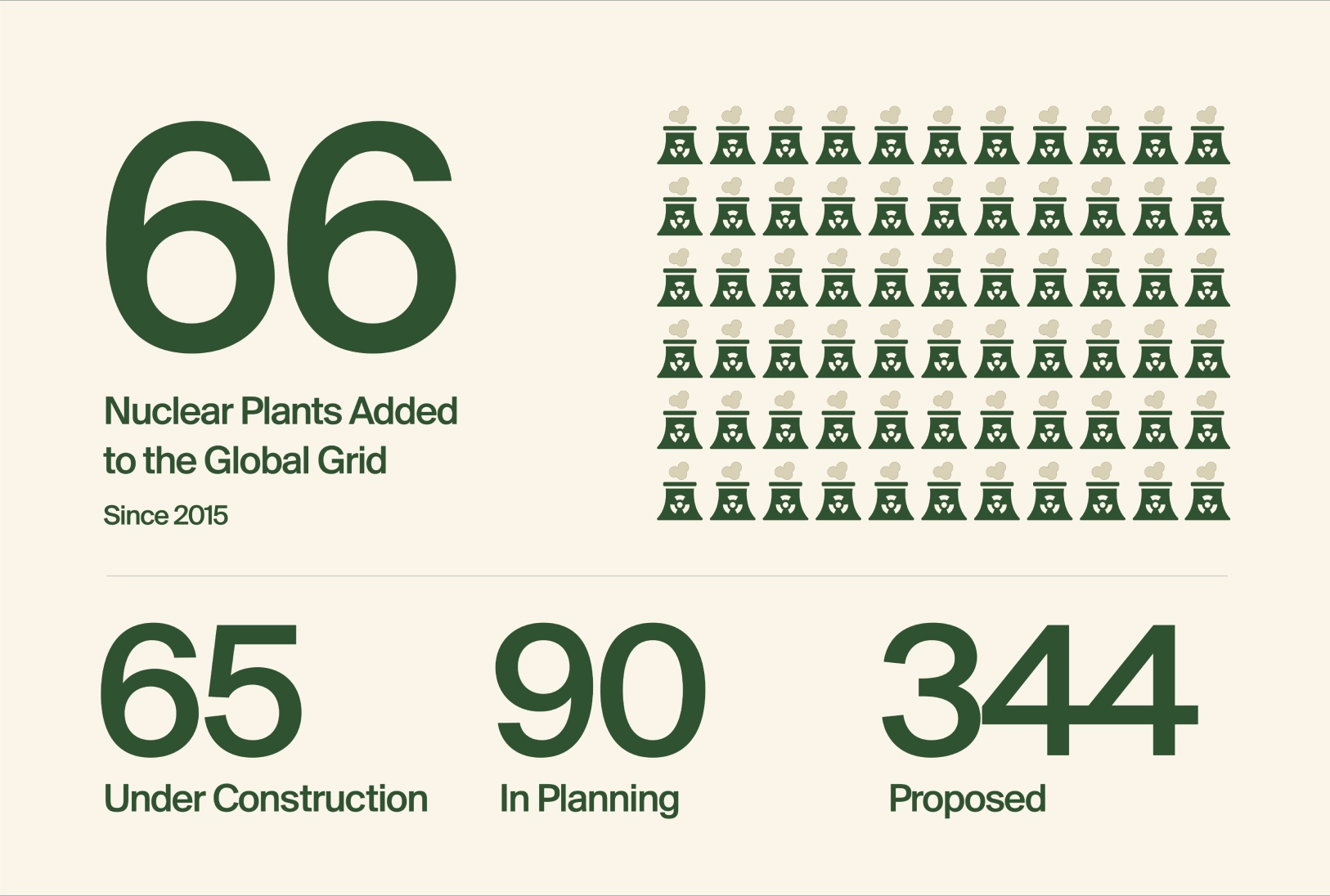

This resurgence of nuclear energy has seen the pipeline of new builds grow. Since 2015 the world has added 66 large-scale nuclear power plants to the global electric grid, with 65 under construction, 90 in planning stage and 344 proposed.[8] Current industry analyst projections forecast at least a doubling of nuclear generation by 2040. This comes from both new builds in countries that seek to add substantial, sources of baseload electric power to their grids, and from the uprating and life extensions of existing units in the established nuclear markets.

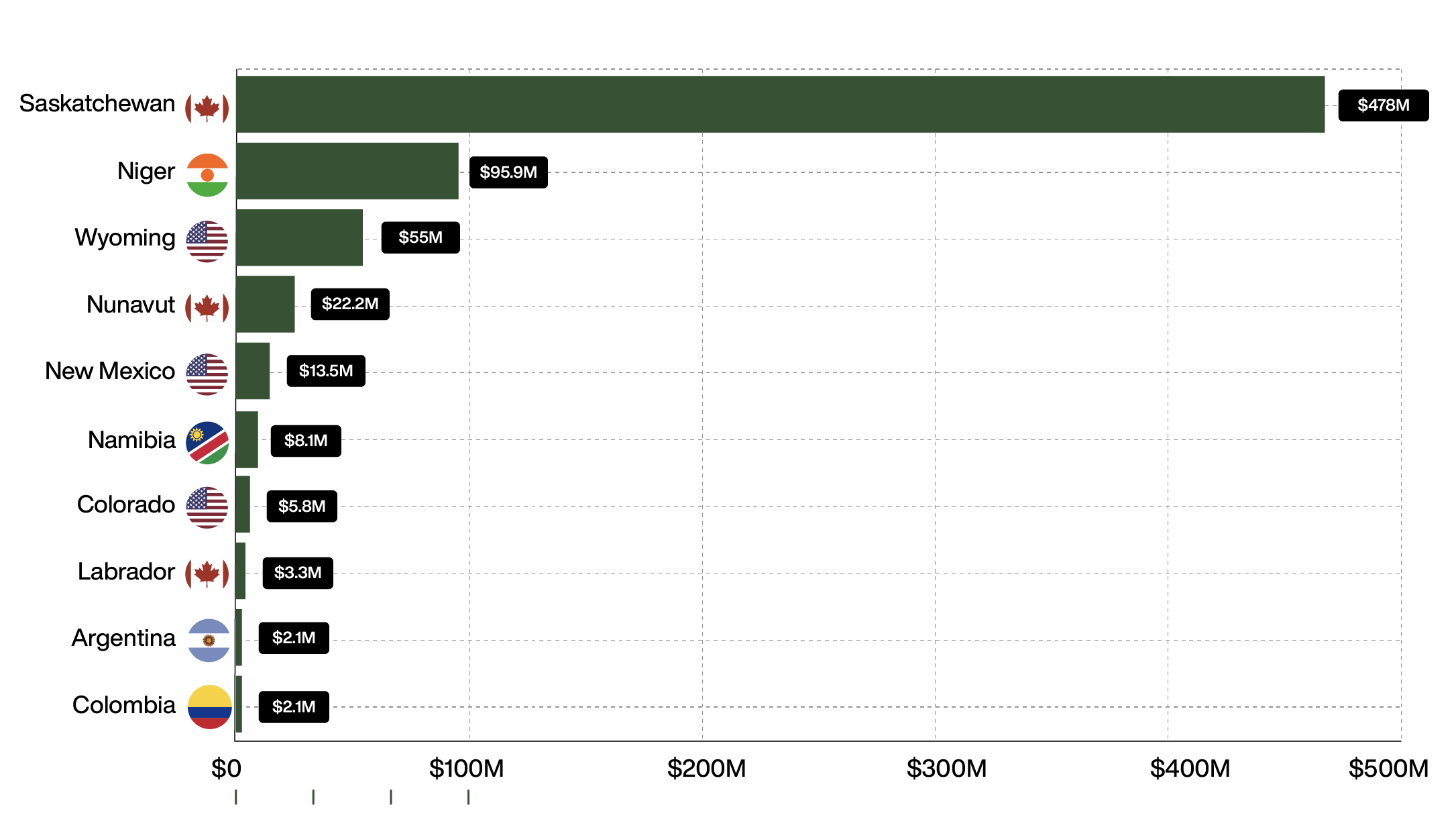

The expansion in nuclear energy comes at a time when the United States has become over reliant on foreign imports of uranium, conversion and enrichment services. Over the last 40 years the uranium market has been burdened by bloated government inventories and aggressive price undercutting from foreign countries like Russia, Uzbekistan and Kazakhstan which have depressed the spot and long-term uranium price. This has led to historic underinvestment in uranium production and new mines globally, especially in the US.

The U.S. is the largest consumer of uranium at 47 Mlbs annually, but produces less than 1% of its total supply.

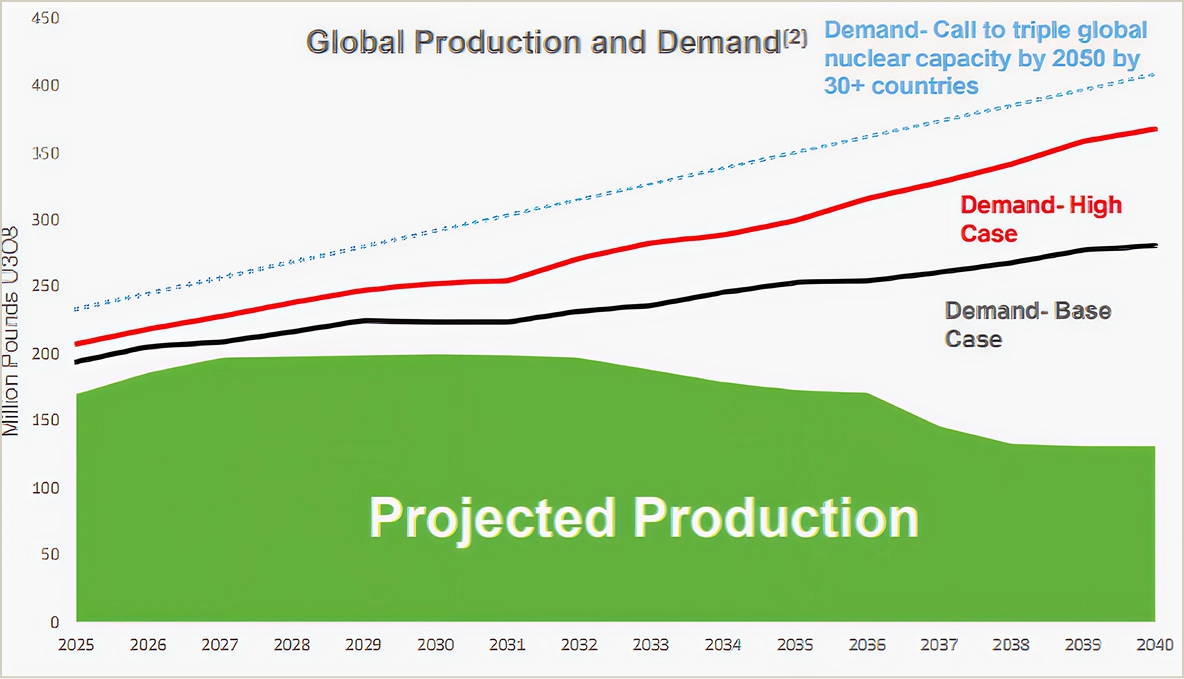

This underinvestment in uranium supply has led to a structural supply deficit between production and requirements that is projected to widen up to 1 B lbs by 2040 (mid case). This growing structural supply deficit has driven up both spot and longer-term prices, which are expected to continue to increase in the coming years.

With the Russian uranium ban in place by the U.S. and now the Russian ban on exports to the U.S., supply has become an even more acute issue for the U.S utilities that are the world’s largest uranium consumer. As we have seen uranium supply become a matter of national security, we have seen the longer-term trend in the utility sector shift, with a renewed emphasis on procuring supply from secure sources with low jurisdictional risk and high geopolitical stability.

Today, there exists bipartisan support to redomesticate the nuclear fuel cycle, including rebuilding American nuclear infrastructure for mining, conversion, enrichment and waste disposal, and to become independent from Russian nuclear fuel supply.

Looming Supply Crunch

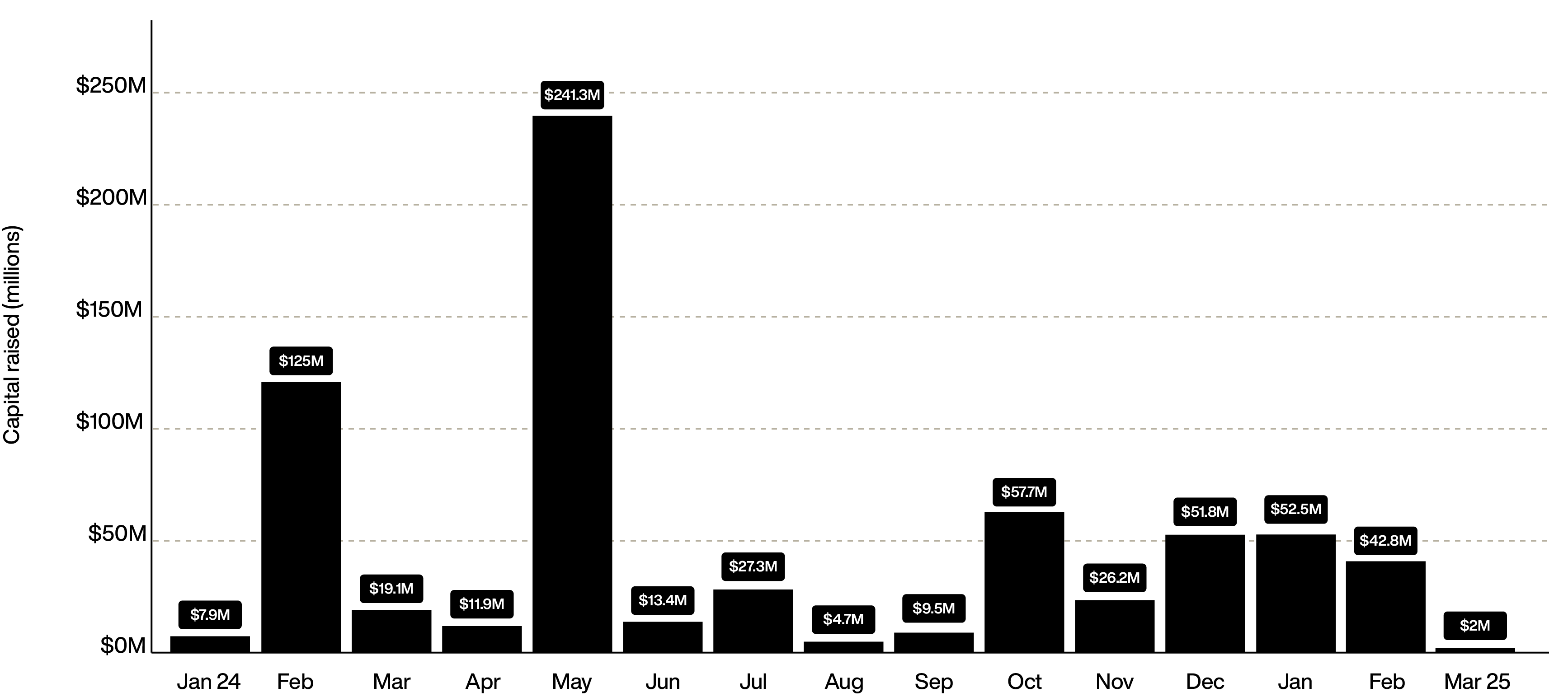

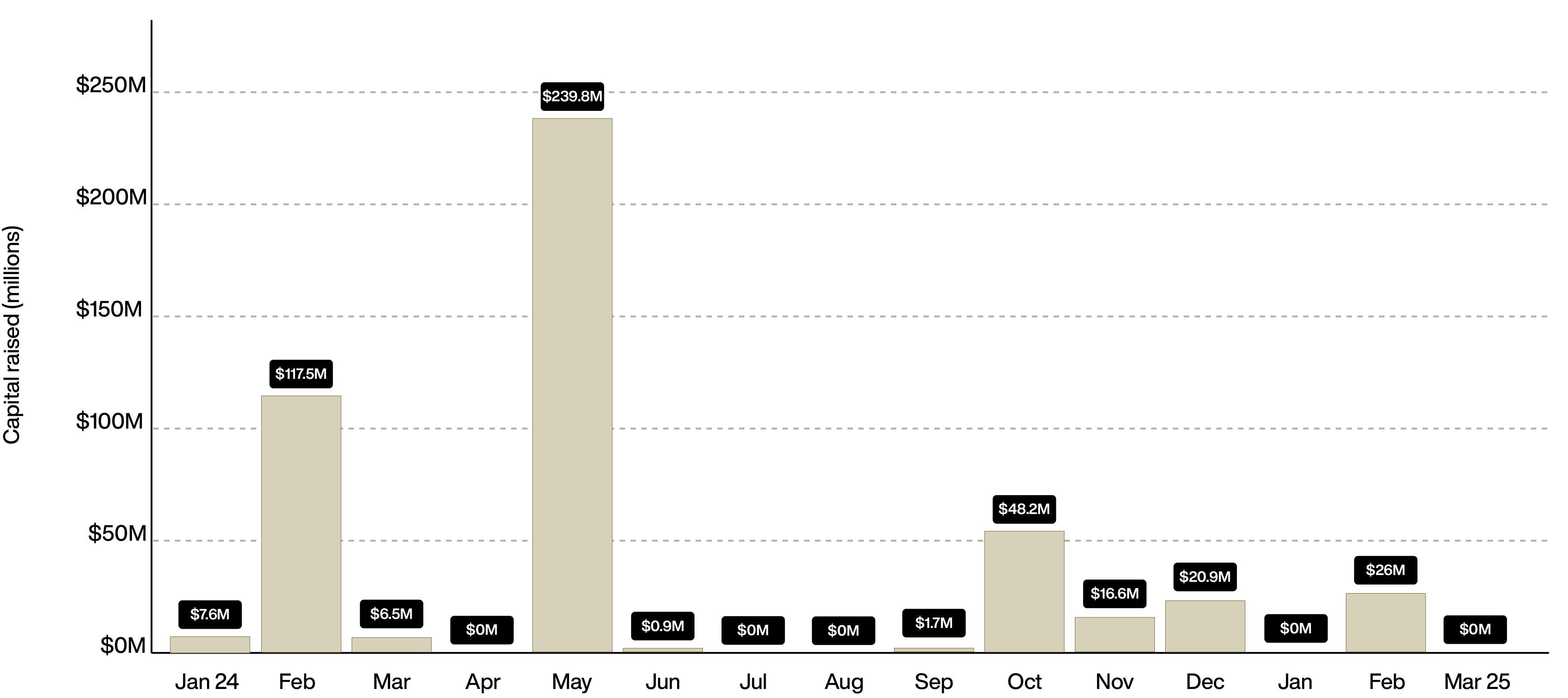

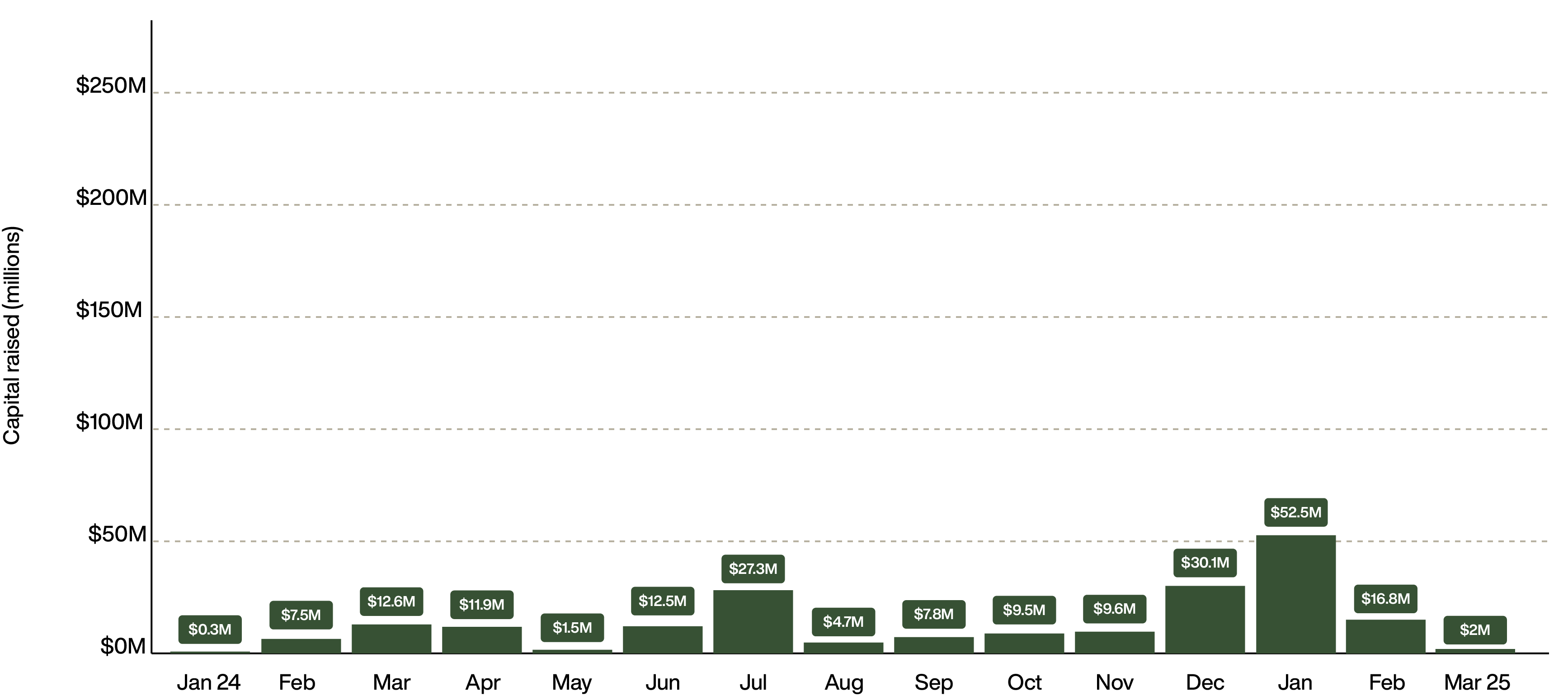

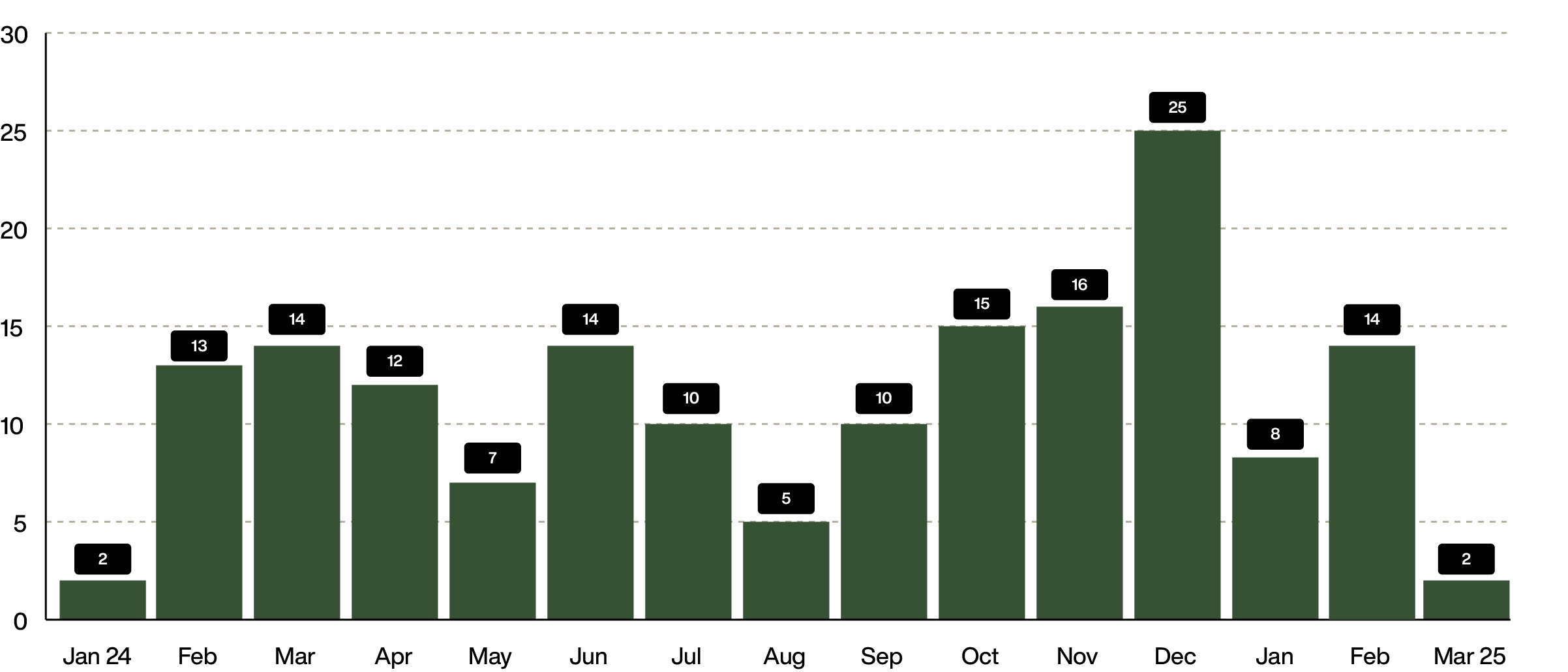

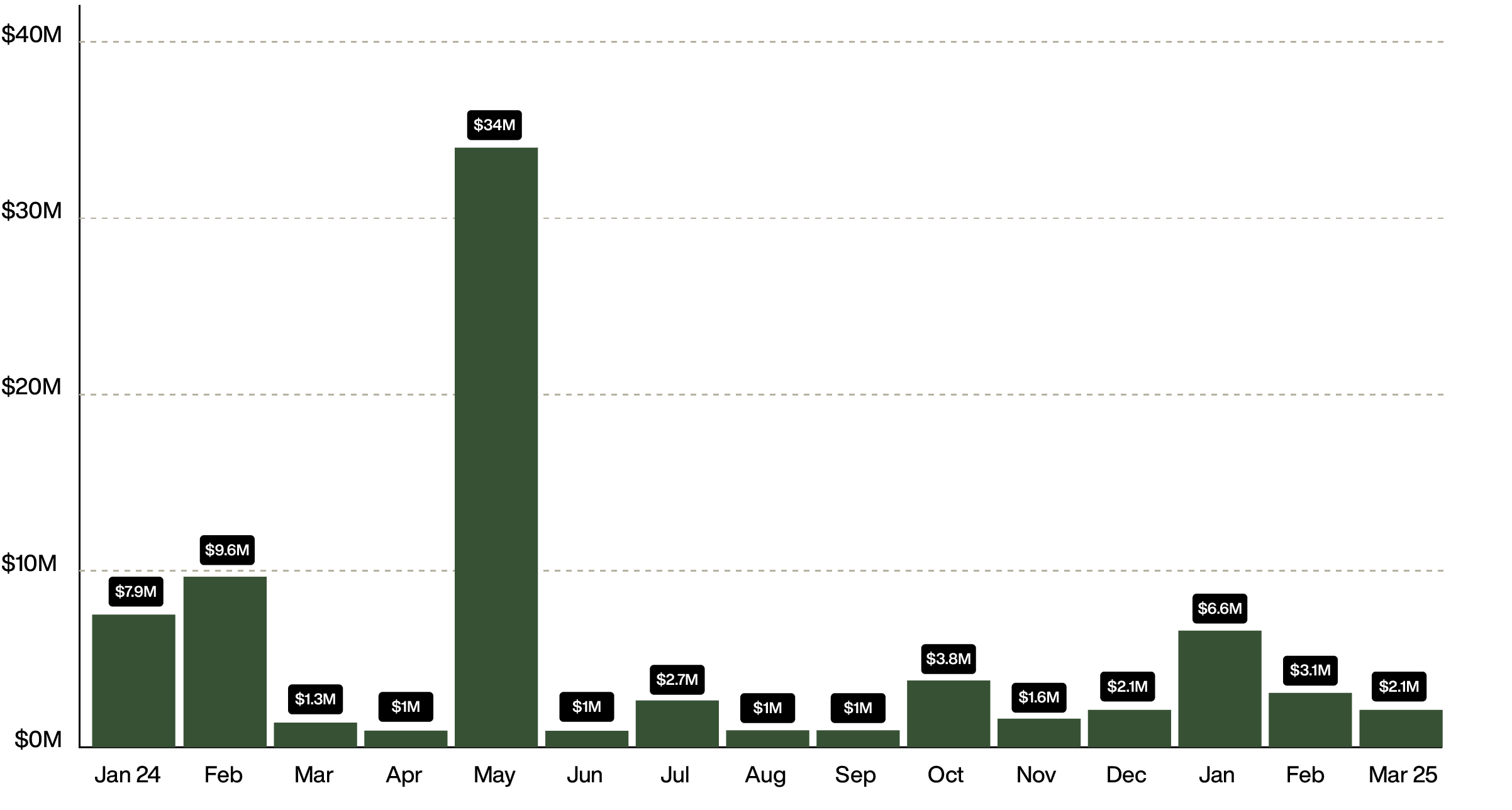

For the last decade, the spot uranium price has slowly creeped up in anticipation of the looming supply crunch. Recent political uncertainty has dwarfed spot purchases and long-term contracting. In 2024, there was a 25% year-over-year decline in long-term contracted volumes as a direct response. Further, 2024 and early-2025 has seen a pull-back in the spot price. This pull back in the uranium price has undermined uranium equities.

However, market fundamentals remain strong, with secondary inventories largely drawn down and reactor demand now outpacing primary production. Utilities will soon be required to re-enter a market with an acute supply crunch - a dynamic that could compress demand into a shorter, more competitive contracting window, further appreciating spot and long-term contracting prices.

For investors, the message is clear: uranium’s fundamentals remain strong, and the current disconnect between equities and uranium prices offers a compelling opportunity.

As Secretary Wright put it, “The golden era of American energy dominance is upon us” and nuclear power, with uranium at its core, is poised to lead the charge.

Resources

[1] https://www.goldmansachs.com/insights/articles/AI-poised-to-drive-160-increase-in-power-demand

[2] https://www.epri.com/research/products/000000003002028905

[3] https://www.iea.org/reports/net-zero-by-2050

[4] https://world-nuclear.org/news-and-media/press-statements/major-global-companies-pledge-historic-support-to-triple-nuclear-energy

[5] https://www.esgdive.com/news/meta-seeks-4-gw-new-nuclear-power-to-meet-ai-sustainability/734642/

[6] https://www.utilitydive.com/news/constellation-three-mile-island-nuclear-power-plant-microsoft-data-center-ppa/727652/

[7] https://www.energy.gov/articles/secretary-energy-chris-wright-delivers-keynote-remarks-ceraweek-2025

[8] https://world-nuclear.org/information-library/current-and-future-generation/plans-for-new-reactors-worldwide#:~:text=Today%20there%20are%20about%20440,are%20building%2C%20new%20power%20reactors.

The End

Contact: [email protected]

Full Disclosure: Uranium Energy Corp. is a paid sponsor of PrivatePlacements.com.

Disclaimer: The service and the contents are provided by the sender and other information providers on an "as is" basis. The sender and any and all other information providers expressly disclaim any and all warranties, express or implied any information herein or on PrivatePlacements.com.

PrivatePlacements.com and its and its owner and its owner's directors, employees, consultants, contractors, agents, and the like ("Representatives"), do not give any tax or investment advice; and do not advocate the purchase or sale of any security or investment. Contents are intended as general information. None of the contents constitutes an: (1) offer to sell or the solicitation of an offer to buy by Blender Media and/or its representatives any security or other investment; (2) offer by PrivatePlacements.com or its owner and/or their representatives to provide investment services of any kind; and/or (3) invitation, inducement, or encouragement by Blender Media and/or its representatives to any person to make any kind of investment decision. You should not rely on the content for investment or trading purposes. Securities or other investments referred to in any of the contents may not be suitable for you, and you should not make any kind of investment decision in relation to them without first obtaining independent investment advice from a person authorised to give it. All communications by PrivatePlacements.com are subject to its terms of use and disclaimer, which can be viewed here and here.

The Company has prepared disclosure in accordance with Canadian reporting standards, which differ from the requirements of the U.S. Securities and Exchange Commission (the “SEC”). The terms “mineral resources”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” used in this presentation are in reference to the mining terms defined in the Canadian Institute of Mining, Metallurgy and Petroleum Standards (the “CIM Standards”), which definitions have been adopted by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”). Accordingly, information contained in this document providing descriptions of our mineral deposits in accordance with NI 43-101 may not be comparable to similar information made public by other U.S. companies subject to the United States federal securities laws and the rules and regulations thereunder. Investors are cautioned not to assume that any part or all of mineral resources will ever be converted into reserves. Pursuant to CIM Standards, “Inferred mineral resources” are that part of a mineral resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. Such geological evidence is sufficient to imply but not verify geological and grade or quality continuity. An inferred mineral resource has a lower level of confidence than that applying to an indicated mineral resource and must not be converted to a mineral reserve. However, it is reasonably expected that the majority of inferred mineral resources could be upgraded to indicated mineral resources with continued exploration. Under Canadian rules, estimates of inferred mineral resources may not form the basis of feasibility or pre-feasibility studies, except in rare cases. Investors are cautioned not to assume that all or any part of an inferred mineral resource is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in place tonnage and grade without reference to unit measures. Canadian standards, including the CIM Standards and NI 43-101, differ significantly from standards in the SEC Industry Guide 7. Effective February 25, 2019, the SEC adopted new mining disclosure rules under subpart 1300 of Regulation S-K of the United States Securities Act of 1933, as amended (the “SEC Modernization Rules”), with compliance required for the first fiscal year beginning on or after January 1, 2021. The SEC Modernization Rules replace the historical property disclosure requirements included in SEC Industry Guide 7. As a result of the adoption of the SEC Modernization Rules, the SEC now recognizes estimates of “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources”. In addition, the SEC has amended its definitions of “proven mineral reserves” and “probable mineral reserves” to be substantially similar to corresponding definitions under the CIM Standards. During the period leading up to the compliance date of the SEC Modernization Rules, information regarding mineral resources or reserves contained or referenced in this presentation may not be comparable to similar information made public by companies that report according to U.S. standards. While the SEC Modernization Rules are purported to be “substantially similar” to the CIM Standards, readers are cautioned that there are differences between the SEC Modernization Rules and the CIM Standards. Accordingly, there is no assurance any mineral reserves or mineral resources that the Company may report as “proven mineral reserves”, “probable mineral reserves”, “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” under NI 43-101 would be the same had the Company prepared the reserve or resource estimates under the standards adopted under the SEC Modernization Rules.