Reports

Gold’s Historic Run and What Comes Next

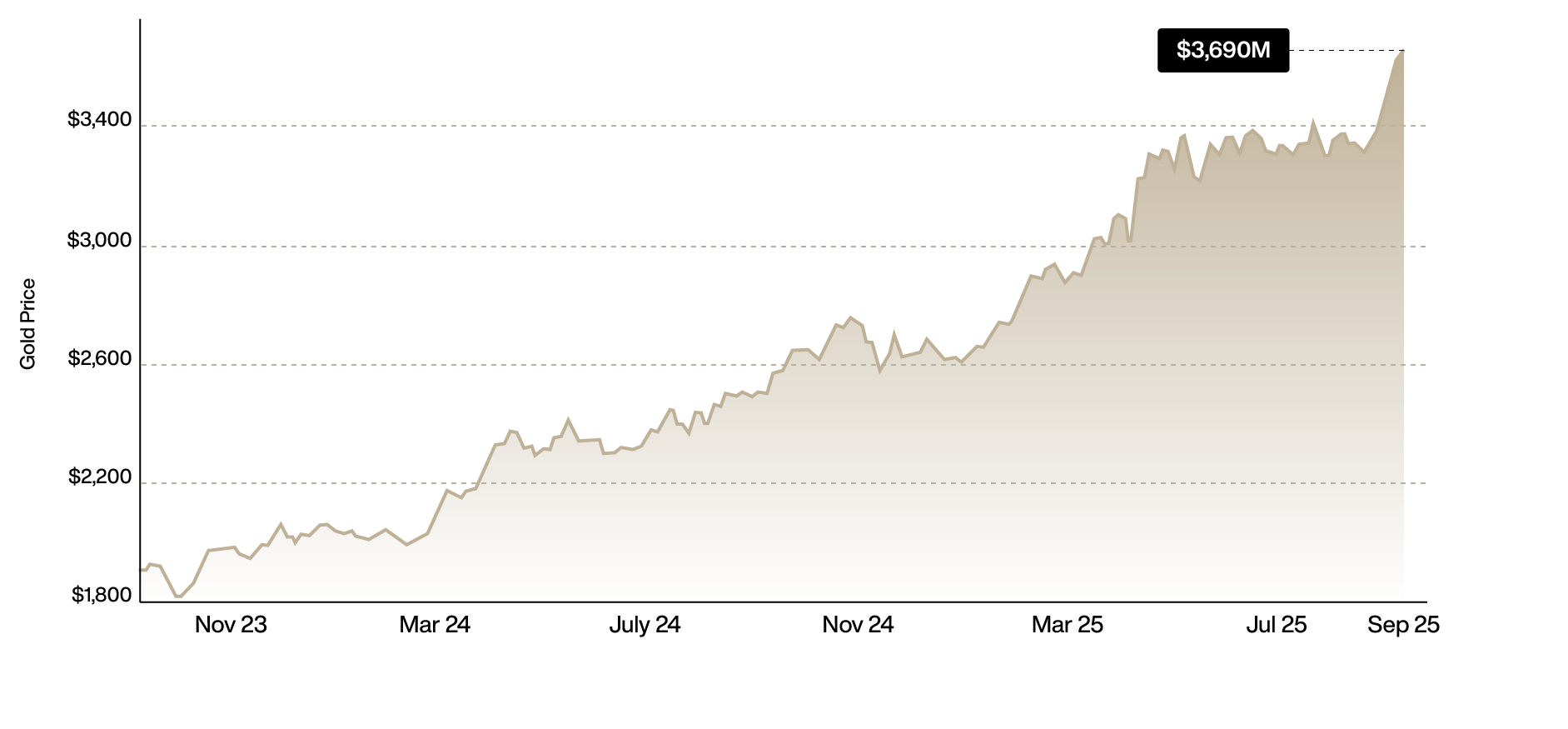

Equity markets have enjoyed a broad rally since early 2024, but gold has been the clear leader, setting new records and reaffirming its role as a core store of value.

In less than two years, the metal has climbed more than 75% in USD terms, reaching record highs of nearly US $3,700/oz in September 2025. Analysts note continued strength in gold prices, driven by expectations of U.S. rate cuts, a weaker dollar, geopolitical volatility, and ongoing central bank demand.

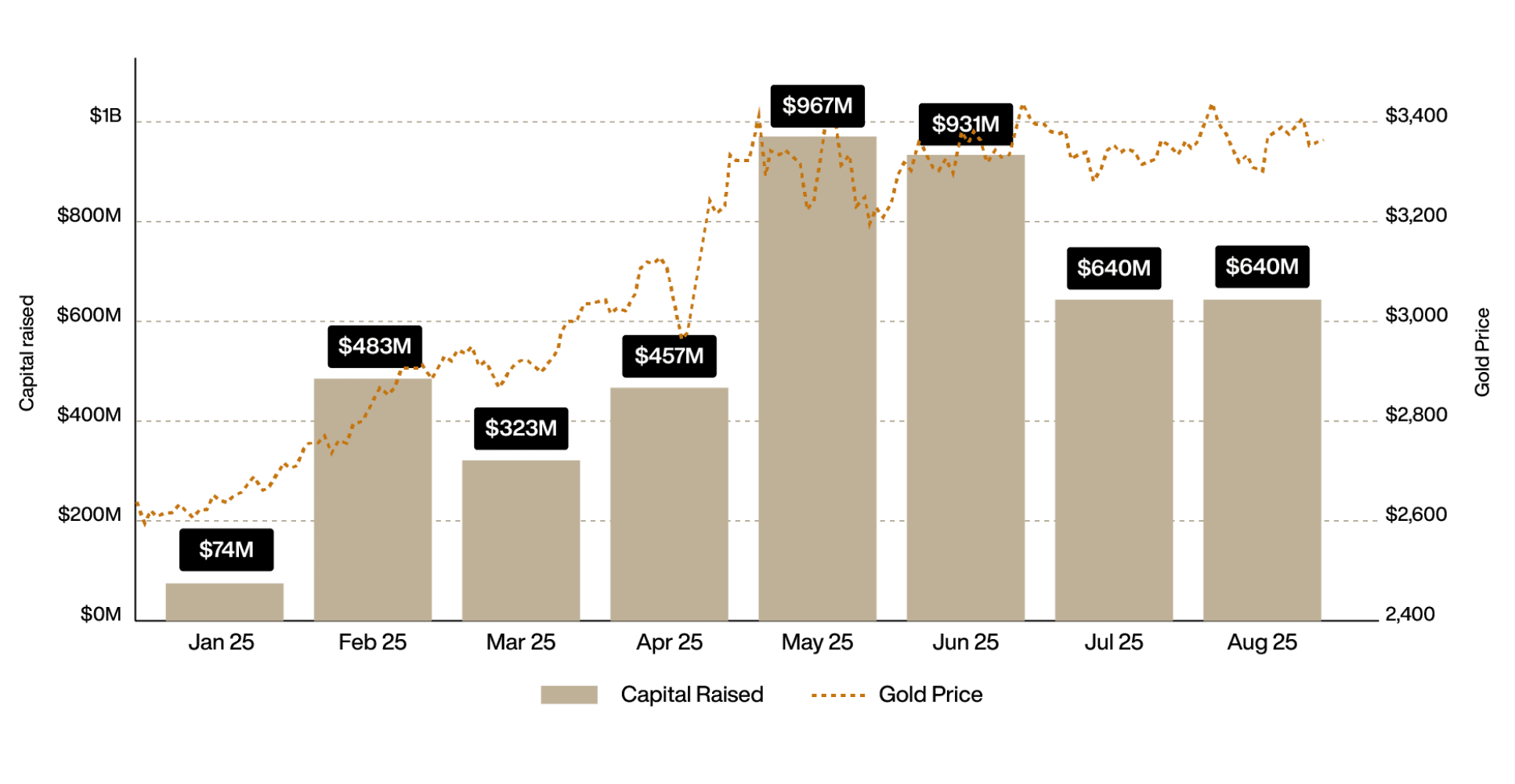

Canadian equity markets, the hub for global juniors, have seen over $4 billion raised in gold financings year-to-date. Deals are larger, oversubscribed, and increasingly directed to juniors. At the same time, producers face shrinking reserve lives and are under pressure to secure new ounces, a dynamic that has historically set the stage for M&A activity.

Total funds raised by Canadian listed gold equities for Jan 1 - Aug 30 2024 vs 2025

Institutions Are Back in Gold

In September, the VanEck Gold Miners ETF (GDX) recorded $530 million of inflows, one of the largest spikes in years. From January to September 2025, gold miners added more than $432 billion in market value, taking the sector’s total market cap from $387B at the end of 2024 to $819B by September 12, 2025.

This reflects a broad institutional rotation into gold miners: pension funds, ETFs, hedge funds, and allocators moving significant capital. For years, the sector was relatively under-owned compared to tech and crypto. Now it has become part of the so-called “old economy revenge trade.”

And notably, despite record highs, there is little evidence of speculative excess in gold equities. Gains have been orderly, investors are taking profits along the way, and valuations remain modest relative to the metal.

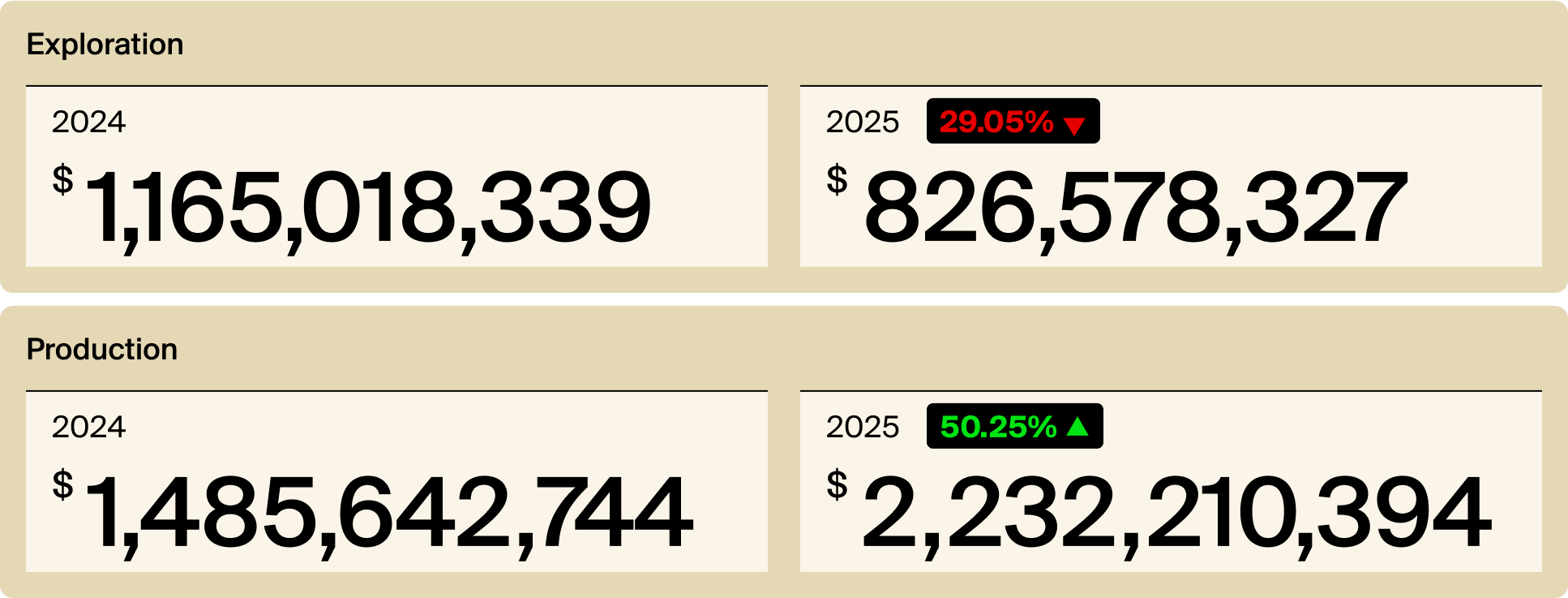

Use of Proceeds for Jan 1 - Aug 30 2024 vs 2025

Takeaways

- Institutions move top-down. They start with senior producers, then mid-tiers, and only later filter capital into juniors. With seniors’ market cap nearly doubling in nine months, the funnel is filling quickly.

- Mining equities are leveraged to gold. Because their costs are relatively fixed, rising gold prices can expand margins faster than the metal itself, creating amplified share price moves.

- Equities remain under-owned. Caution has kept participation moderate, leaving room for expansion.

- Reserve pressure supports consolidation. Periods of declining reserves and strong gold prices have often led to M&A in past cycles.

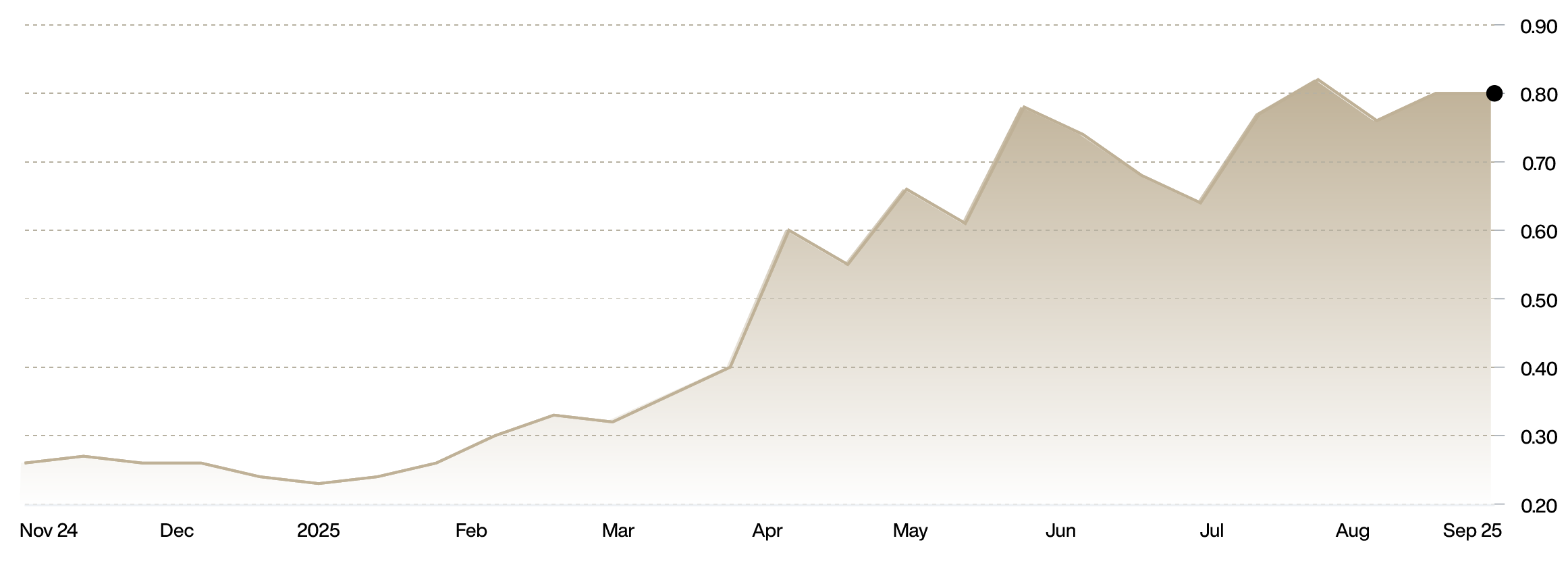

With capital rotating back into miners and producers facing reserve pressure, investors are starting to look downstream for juniors positioned to benefit. Our sponsor, Fortune Bay Minerals (TSXV: FOR | OTCQX: FTBYF), is one example, combining a development-stage Canadian gold project, a historical resource in Mexico, and a partner-funded uranium kicker. Importantly, the company recently announced an updated PEA for its Goldfields Project in Saskatchewan, delivering a refreshed economic picture under today’s gold environment.

Sponsor Snapshot: Fortune Bay Minerals

(This is a paid sponsorship. Information is based on publicly available company disclosures.)

- Ticker: TSXV: FOR | OTCQB: FTBYF

- Primary focus: Gold (Saskatchewan & Mexico), with partner-funded uranium (Saskatchewan)

- Recent and near-term catalysts (2025): Updated Goldfields PEA, consultation and environmental work in SK, community exploration agreements+ initial fieldwork at Poma Rosa (MX), and partner-funded uranium drilling

- Cash position: C$1.75M (June 30, 2025)

- Share structure: ~58M basic; 71.2M FD (9.3M warrants, 3.8M options). Insiders ~17%

- Price/Cap: ~C$0.90; ~C$51M market cap

Why Invest?

- Focused Business Model – Fortune Bay concentrates on the part of the Lassonde Curve where juniors historically create the most value: discovery, resource expansion, and early-stage development. The company’s approach is to advance projects through these phases before major capital commitments are required.

Lassonde Curve

Typical value/excitement cycle of a mining project from concept to production

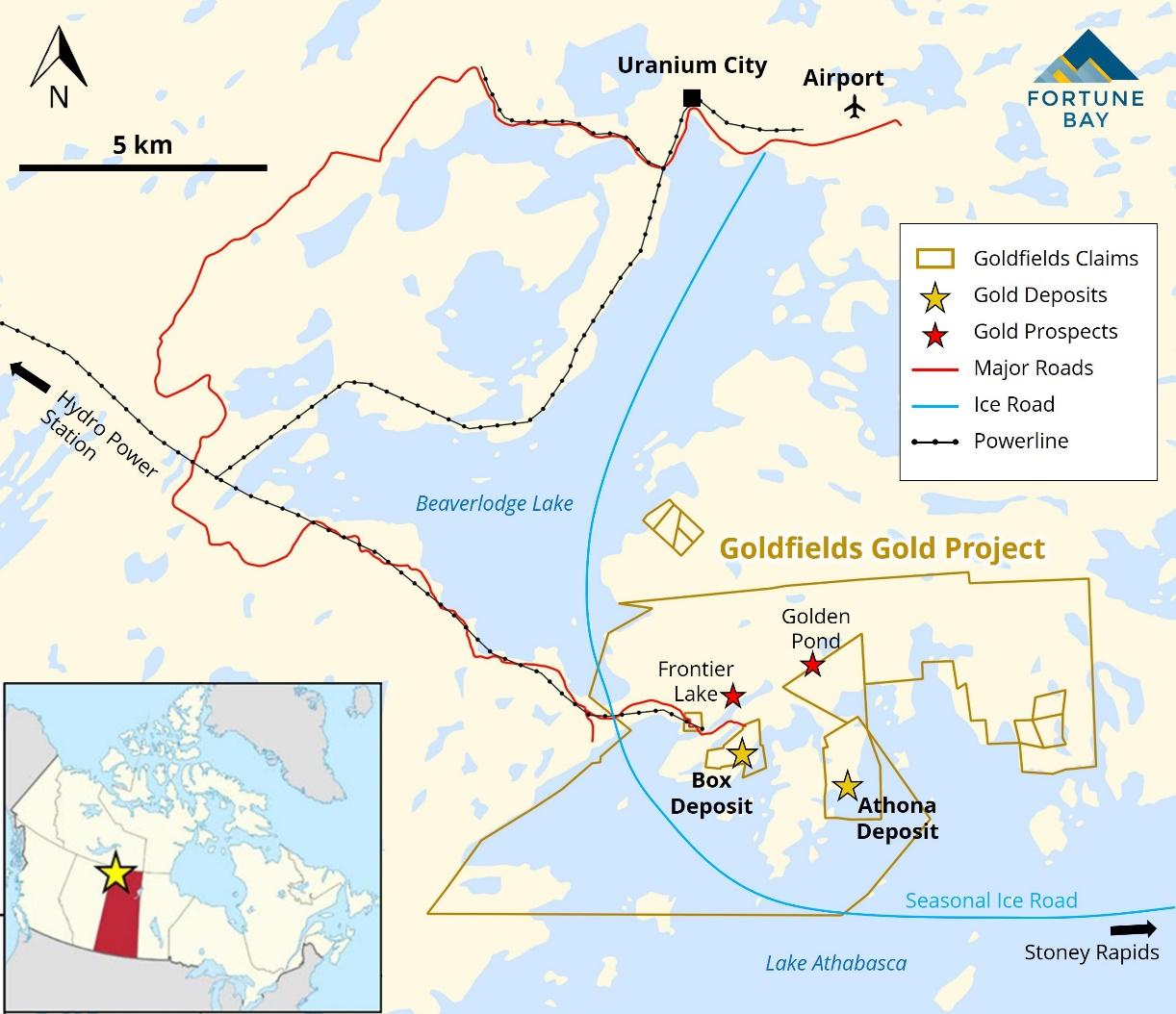

- Dual-Jurisdiction Gold Portfolio – The 100%-owned Goldfields Project in Saskatchewan is a development-stage asset in a top-tier jurisdiction. In Mexico, the Poma Rosa Project provides scale potential, with a historical gold resource and additional exploration targets.

- Disciplined Capital Structure – With ~58M shares outstanding and ~17% insider ownership, Fortune Bay has maintained a relatively tight share structure. Partnerships on its uranium assets generate income and help fund activity without direct dilution.

- Experienced Leadership – Management combines technical and market expertise: the CEO has a track record in discovery and early development, while the Executive Chairman has a history of building and financing resource companies.

- Recent Catalyst – Fortune Bay’s updated PEA for Goldfields, announced September 23, 2025, delivered stronger economics, a longer mine life, and a refreshed outlook under today’s gold environment.

- Upcoming Catalysts – Additional milestones include community groundwork at Poma Rosa and partner-funded uranium drilling, all of which provide potential news flow through 2025–2026.

The Projects

Goldfields (Saskatchewan) – Development-Stage Flagship

Fortune Bay’s 100%-owned Goldfields Project in northern Saskatchewan is a development-stage with a recently completed updated PEA announced on September 23rd, outlining a stronger, longer-life mine plan in one of the world’s top mining jurisdictions.

Highlights of the updated PEA:

- After-tax NPV (5%): C$610M at US$2,600/oz (base); C$1,253M at spot US$3,650/oz (Sept 19, 2025).

- IRR: 44% (base), ~74% at spot.

- After-tax cumulative FCF: C$914M (base); C$1,817M (spot).

- Mine life: ~13.9 years, 896,000 oz payable gold.

- Resource confidence: 97% Indicated ounces in the plan.

- De-risked development: <5,000 tpd throughput designed to stay within provincial permitting; 2008 EIS remains valid.

What’s changed since the 2022 PEA?

Economics are meaningfully stronger and the mine life is longer (from ~8.3 years to ~13.9 years), even after accounting for higher costs and capex. In short, Goldfields screens as a low-capex, high-return development with strong leverage to gold.

With permitting activities underway and pre-feasibility/de-risking work ahead, the Updated PEA strengthens the investment case for Fortune Bay in this gold cycle.

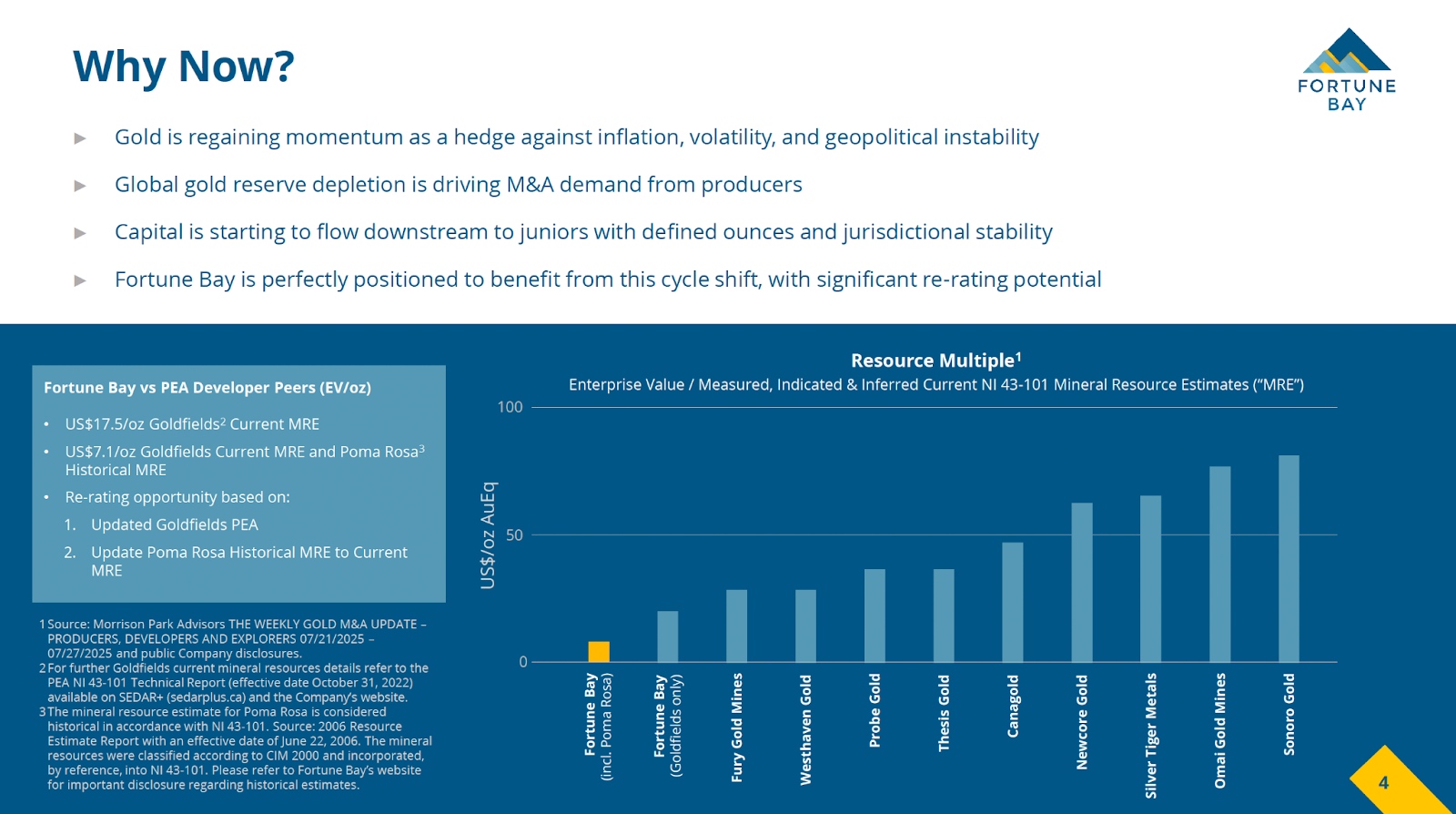

Why the Updated PEA Matters

PEA-stage developers are often evaluated on enterprise value per ounce (EV/oz) or NAV multiples. Fortune Bay’s 2022 PEA, completed at a gold price of US $1,650/oz, already demonstrated positive economics. With gold now near US $3,700/oz, the updated PEA provides investors with a new reference point under today’s market conditions.

Despite this, Fortune Bay currently trades at a discount to several peer developers, even though Goldfields is 100%-owned, located in a Tier 1 jurisdiction, and advancing with a permitting foundation already in place. The company’s corporate presentation illustrates this valuation gap in its EV/oz peer comparison. The updated PEA will add fresh data to that picture and allow the market to better assess how Goldfields stacks up.

Poma Rosa (Chiapas, Mexico) – Historical Resource with Growth Potential

If Goldfields is the anchor, Poma Rosa (formerly Ixhuatán) provides scale potential.

The project hosts a historical gold resource estimate of ~1.7 Moz:

- 1.04 Moz @ 1.80 g/t (Measured + Indicated)

- 0.70 Moz @ 1.0 g/t (Inferred)

Fortune Bay is advancing community consultation to enable field work, which would support conversion of this historical estimate into a current NI 43-101 resource and additional exploration. The company has also noted the presence of a deeper porphyry target, which requires further drilling to evaluate.

An amparo (injunction) protects concession rights, and the company reports constructive engagement with local communities.

Uranium (Athabasca Basin, Saskatchewan) – Partner-Funded Portfolio

Fortune Bay’s uranium assets provide additional exposure without direct shareholder dilution.

- Murmac & Strike (optioned to Aero Energy): Aero may earn 70% over 3.5 years by funding C$6M in exploration plus cash/shares. Fortune Bay acts as operator and collects a 10% fee. Past drilling intersected grades up to 13.80% U₃O₈. Drilling is scheduled for fall 2025.

- The Woods Projects (optioned to Neu Horizon Uranium): Neu Horizon may earn 80%. The ~40,000 ha property along the Grease River shear has drill permits in place. Geophysics is underway; drilling is anticipated in 2026.

The Team

Dale Verran – Chief Executive Officer

Mr. Verran is an exploration geologist and mining executive with more than 25 years of international experience in Africa and Canada. He has a proven track record in project generation, discovery, and advancement. Prior to Fortune Bay, he was Vice President of Exploration at Denison Mines, where he contributed to discoveries totaling over 70 million pounds of U₃O₈. His career also includes senior technical and leadership roles with Remote Exploration Services and Manica Minerals, as well as early exploration work with Gold Fields Limited.

Wade K. Dawe – Executive Chairman

Mr. Dawe is an entrepreneur and financier with a record of founding and building resource companies. He co-founded Keeper Resources Inc., sold in 2008 for C$51.6 million, and Brigus Gold Corp., acquired in 2014 by Primero Mining in a share transaction valued at C$351 million.

Robert Shaw – Independent Director & Technical Advisor

Mr. Shaw has over 30 years of mineral exploration experience throughout the Americas. He has founded and served as an executive of publicly listed gold companies and was instrumental in the discoveries of Gramalote, La Colosa, and La Quebradona, which together represent more than 40 million ounces of gold.

Catalysts on Deck (2025–2026)

- Fortune Bay has identified several upcoming activities:

- Q3 2025: Updated PEA at Goldfields

- 2H 2025: Consultation and permitting work at Goldfields

- Year-End 2025: Community groundwork at Poma Rosa

- Fall 2025: Uranium drilling at Murmac

- 2026: Exploration drilling at Goldfields, Poma Rosa, and The Woods uranium projects

Conclusion

The current gold cycle has brought record prices, renewed institutional inflows, and a financing environment that increasingly favors juniors. Within this backdrop, Fortune Bay offers several near-term developments that could draw investor attention.

-

At Goldfields in Saskatchewan, an updated PEA is expected in Q3 2025, followed by consultation and permitting updates into Q4. This work advances the project’s development case while providing fresh data points for comparison against peers.

-

In Mexico, community agreements at Poma Rosa are targeted for completion in Q4 2025, enabling the reactivation of exploration and the conversion of the historical resource into a current NI 43-101 estimate. Drilling would follow to test both resource expansion and porphyry potential.

-

In uranium, partner-funded programs continue at Murmac, Strike, and The Woods, with drilling slated for later in 2025 and 2026. These agreements generate activity and income while preserving Fortune Bay’s focus on gold.

-

The company has also indicated that strengthening its technical team is under consideration to support this expanded pipeline of work.

Together, these activities align with broader sector dynamics: producers under reserve pressure, capital rotating toward juniors, and M&A activity regaining momentum. Fortune Bay’s dual-jurisdiction gold portfolio, combined with non-dilutive uranium partnerships, places it among the juniors to watch as the cycle unfolds.

Disclaimer

This report is a paid advertisement on behalf of Fortune Bay Corp (the “Company”). Blender Media Inc has been compensated by the Company for investor awareness services. This communication is not, and should not be construed as, an offer to sell or the solicitation of an offer to buy securities. It contains forward-looking statements subject to risks and uncertainties. Readers should review the Company’s continuous disclosure filings available at www.sedarplus.ca before making investment decisions. Blender Media Inc and its principals may own shares or warrants of the Company and may benefit from its appreciation. Investing in early-stage resource companies is highly speculative and involves significant risk of loss. Do your own independent due diligence.

The service and the contents are provided by the sender and other information providers on an "as is" basis. The sender and any and all other information providers expressly disclaim any and all warranties, express or implied any information herein or on PrivatePlacements.com.

PrivatePlacements.com and its and its owner and its owner's directors, employees, consultants, contractors, agents, and the like ("Representatives"), do not give any tax or investment advice; and do not advocate the purchase or sale of any security or investment. Contents are intended as general information. None of the contents constitutes an: (1) offer to sell or the solicitation of an offer to buy by Blender Media and/or its representatives any security or other investment; (2) offer by PrivatePlacements.com or its owner and/or their representatives to provide investment services of any kind; and/or (3) invitation, inducement, or encouragement by Blender Media and/or its representatives to any person to make any kind of investment decision. You should not rely on the content for investment or trading purposes. Securities or other investments referred to in any of the contents may not be suitable for you, and you should not make any kind of investment decision in relation to them without first obtaining independent investment advice from a person authorised to give it. All communications by PrivatePlacements.com are subject to its terms of use and disclaimer, which can be viewed here and here.