Low-cost, high-efficiency production of tomorrow's $2.5B "wonder material"

Low-cost, high-efficiency production of tomorrow's $2.5B "wonder material"

HydroGraph Clean Power Inc. (CSE: HG; OTCQB: HGCPF)

The story at a glance:

-

Growing market opportunity: Graphene is an incredibly versatile supermaterial projected to reach a US$2.5 billion market by 2028 (Allied Market Research)

-

High-quality, low-cost, and consistent: HydroGraph's patented Hyperion system produces graphene at 99.8% purity with a consistency unrivaled in the market, at one of the lowest capital costs in the industry

-

Microscopic environmental footprint: Requiring only oxygen and acetylene as raw materials, HydroGraph's system produces graphene with zero greenhouse gas emissions, no solvents, and very little energy

-

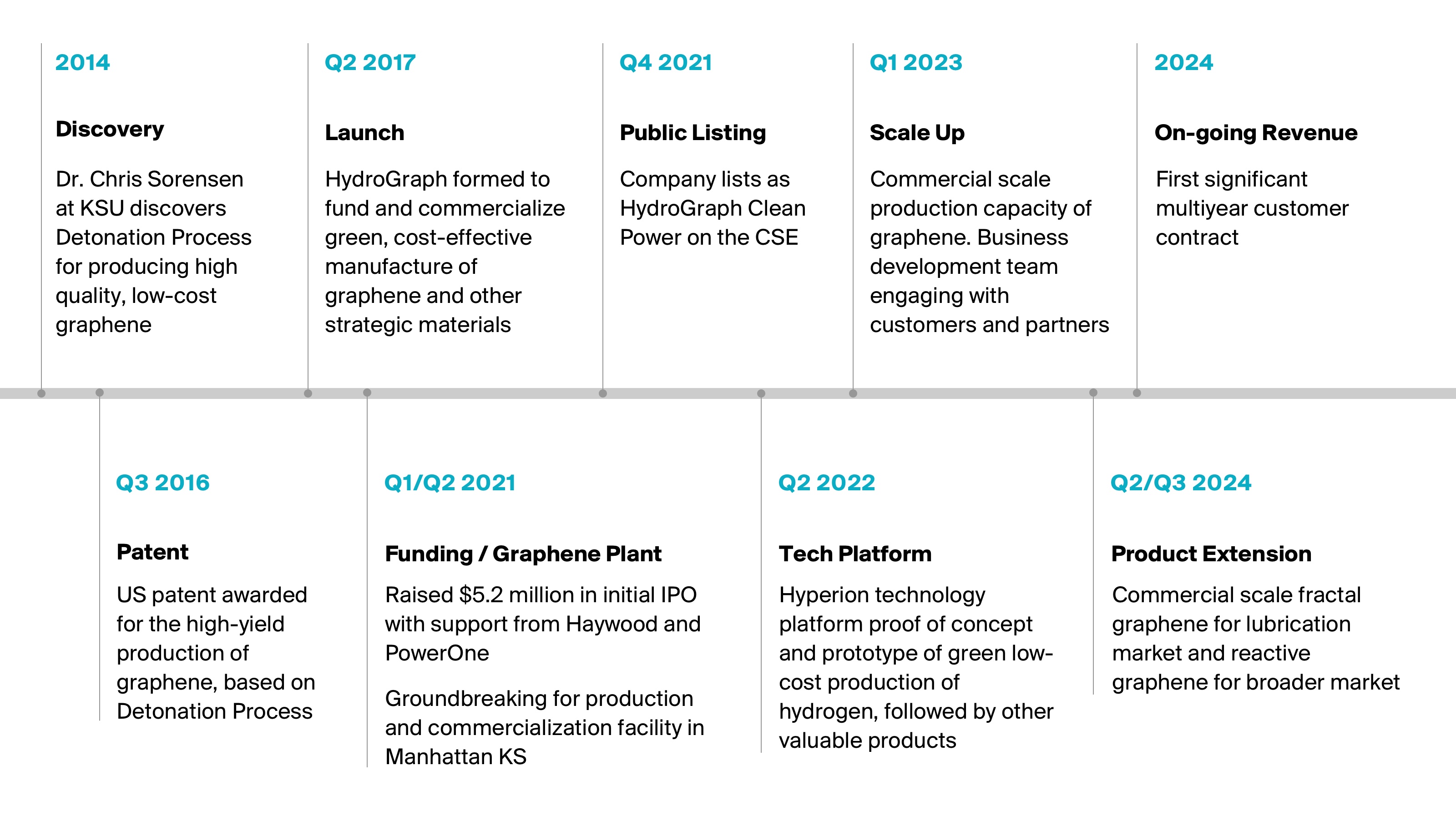

Scaling up production: HydroGraph has recently completed construction on their commercial-scale fractal graphene unit, making investment in the company a simple business development play

-

Customers in the pipeline: With over 40 material customer engagements, 17 NDAs/testing agreements, and 20 different applications being discussed, it may be only a matter of months before HydroGraph secures its first, significant multiyear customer contract, which could have huge impact on share prices

-

Customization: HydroGraph’s graphene can be nano-engineered, resulting in customized graphene for specific customer applications and materials—yet another advantage over competitors

LEARN MORE ABOUT THE COMPANY HERE

A company making big moves under the radar, with game-changing catalysts

One of the most thrilling aspects of venture exchanges is stumbling upon a business engaged in exciting endeavors that were previously unknown to you, with little to no recognition from the mainstream.

When you do consider investing in such a company, it's essential that you understand precisely where they are at in their growth timeline.

It's important to always look for companies with potential, upcoming milestones that could have a significant impact on the company's trajectory—and on its perception on the street.

An ideal company is one that has developed a product that quietly outperforms its competition, offering a product or service that has the prospect of making a big shift in a key industry. Even better is one that ticks those boxes, but is also on the cusp of entering the larger market, establishing itself among its customers, and opening the floodgates to business.

Haven't heard of graphene? That's fine, we'll enlighten you below. For now, just understand that it's a "wonder material" with an array of incredible properties that make it potentially transformative to a wide slate of industrial applications.

But before HydroGraph developed its proprietary tech, the production of graphene was complicated, expensive, inefficient, and inconsistent. This has led to patchy adoption in the sectors in which it could have a huge impact.

HydroGraph has already moved past its proof-of-concept. Its build-out timeline is far shorter than its competitors, and it has been producing sample amounts of its graphene for prospects for months now.

What it needs now is that first big customer announcement.

It's no sure thing, but if the company is able to land that first big client, it would confirm its place in the market, leading the way for further customers.

The company aims to announce its first major customer partnership between late 2023 and early 2024, with corresponding revenue in the later part of 2024. That's a near-term event that could have a huge impact on the stock.

HydroGraph has already removed most of the technical risk associated with the industry, making it a compelling investment opportunity.

Below, we'll get into the details.

Graphene is poised to explode in the market. HydroGraph is leading the charge with unmatched purity and affordability.

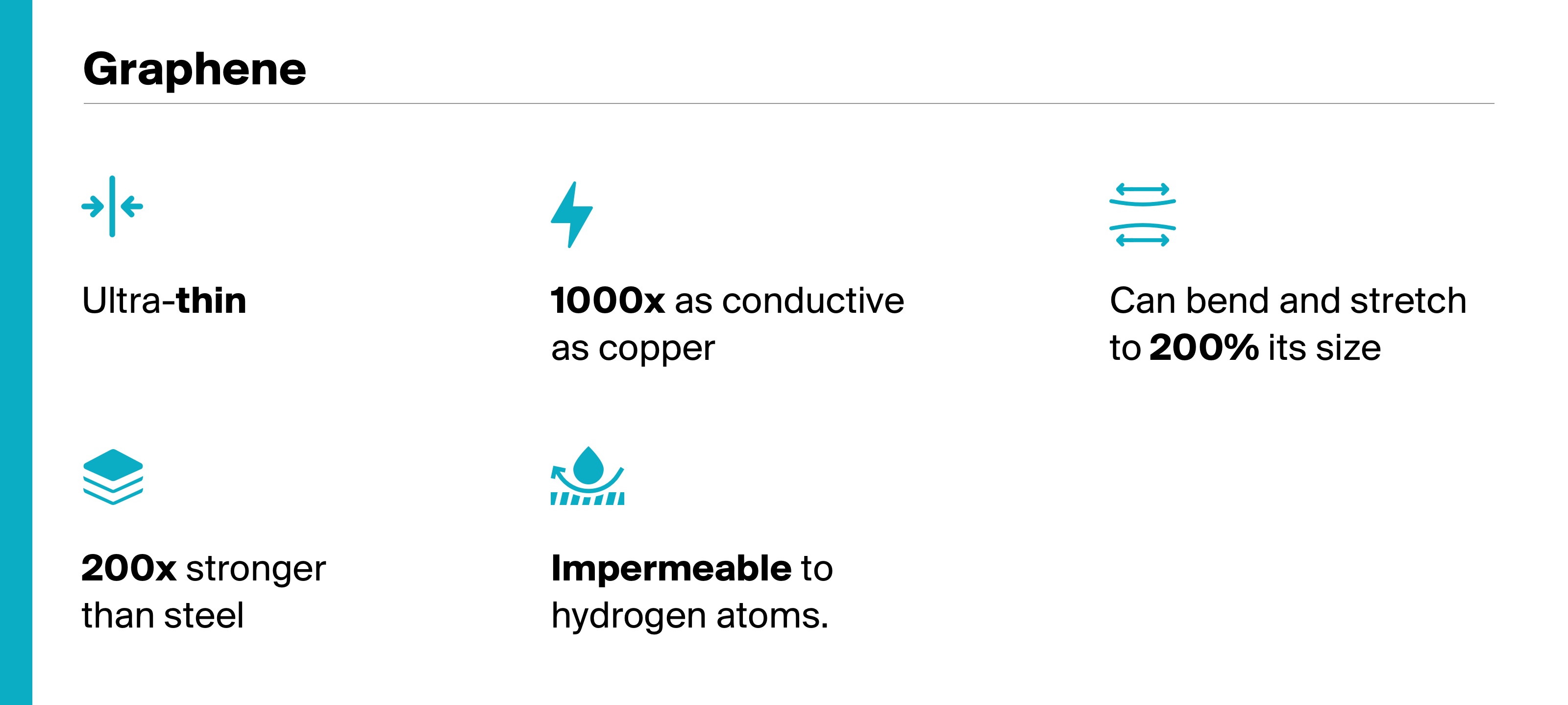

Stronger than steel, harder than diamond, and more conductive than copper, graphene is the supermaterial of the future.

As the thinnest two-dimensional nanomaterial in the world, graphene has a tremendous array of applications in industry, ranging from material coatings and alloys to conductive lubricants, to superior battery technologies and beyond.

The problem is past companies making graphene produced the material with complex processes, creating graphene of inconsistent, low purity with high capital expenditures and outsized environmental impact.

Until now: HydroGraph has developed a simple, proprietary method to consistently produce graphene at 99.8% purity, creating what we believe to be the most cost-effective graphene in the market.

The next big catalyst is for the company to secure a multiyear customer contract with a banner name, establishing itself across the sector.

The global graphene revolution has already begun.

Graphene isn't well-known in most non-expert circles. But market demand for the material is growing at a stunning rate.

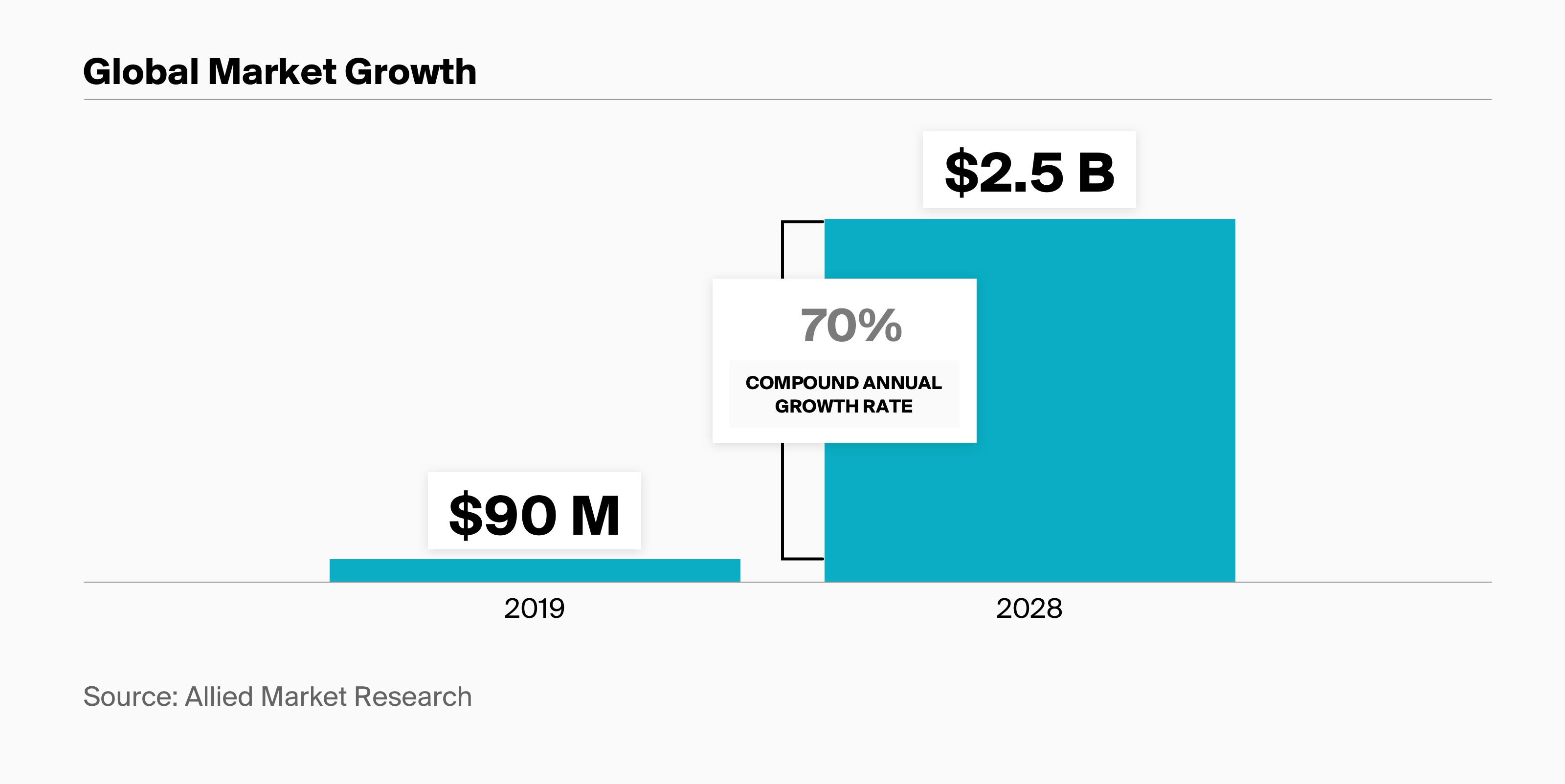

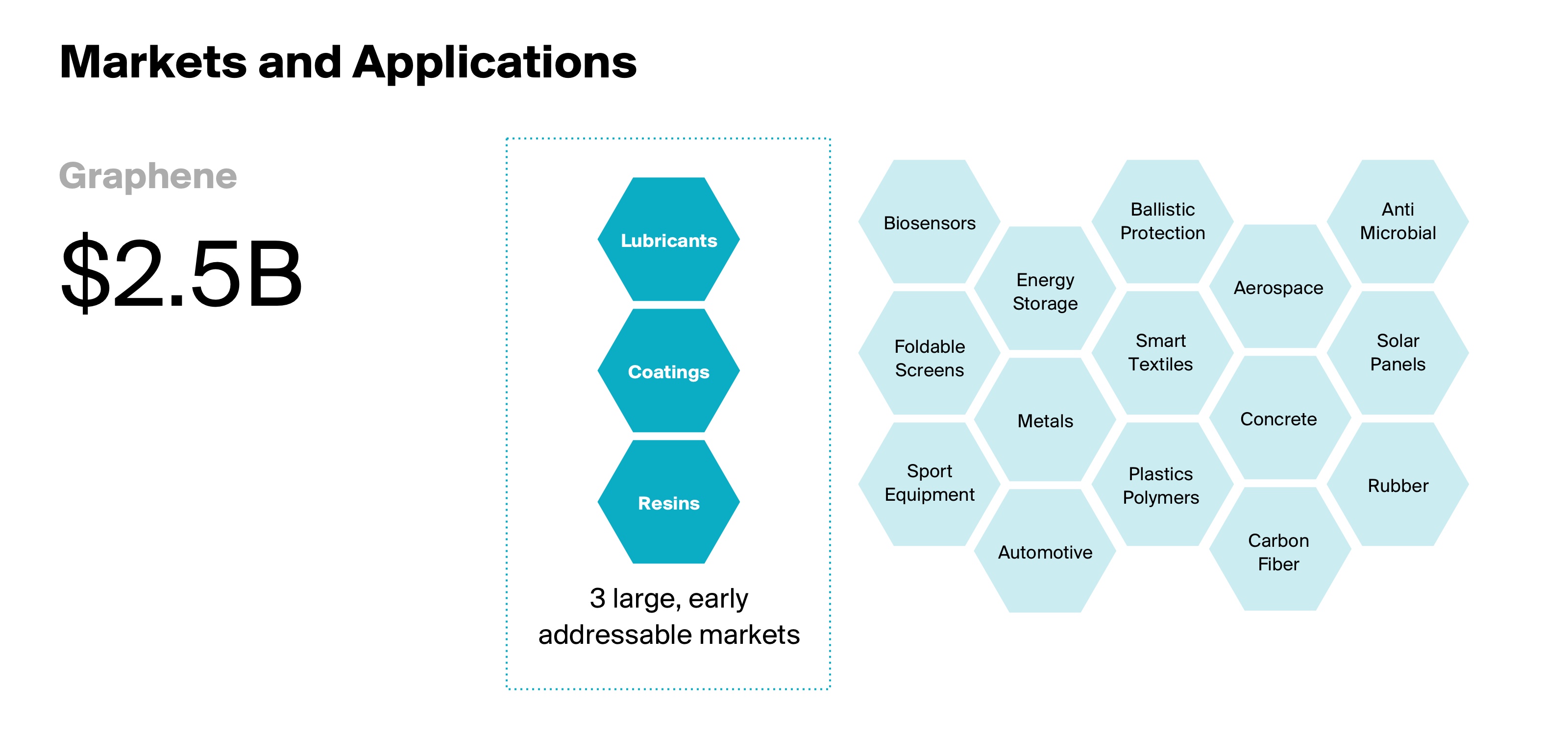

Today, the global graphene market is valued at only about $150 million. But Allied Market Research projects that it will reach $2.5 billion by 2028, at a staggering compound annual growth rate of 70%.

But other than simple dollars and cents, why should graphene be on your radar, and what is it used for?

Like diamonds, coal, or its less-refined cousin graphite, graphene is an allotrope of carbon—a specific arrangement of carbon atoms that give it its specific characteristics.

Graphene's stats sound like science fiction: it's ultra-thin, 200x stronger than steel, 1000x as conductive as copper, can bend and stretch to 200% its size, and is impermeable to hydrogen atoms.

Graphene offers opportunities to improve mechanical, electrical, thermal, and barrier properties, enabling the development of advanced composite materials with enhanced functionalities. Basically: it's super versatile with huge impacts.

These characteristics make it attractive in a wide variety of applications: coatings and wearable technologies, lubricants, industry resins, composite materials and alloys, filtering and purification, superior battery tech, improved computer chips, and much more.

It's a material with truly transformative potential for a wide variety of industries. Just as one example, HydroGraph's graphene has recently been shown to improve the operating life of base oil lubricants by more than 24 times.

That's a big increase for a key component in the US$136 billion lubrication market.

Another potential application HydroGraph is investigating is using its graphene in lithium-air batteries. In a recent air battery test, HydroGraph's graphene surpassed the performance of leading cathode carbon materials, delivering the highest discharge capacity, with superior performance at higher energy densities.

It's easy to see why any compound that can offer superior performance and better economics to the air battery industry could be a huge deal.

But if graphene is so great, why isn't the market for it massive already? Why isn't it a household name?

The primary reason the graphene market has, until now, been only in the tens of millions is that it has historically been difficult to produce, limiting industry impact.

Most graphene producers have done so with enormously complicated methods, at massive cost and with inconsistent results. These methods were expensive and not scalable, employing toxic chemicals and vast amounts of electricity.

But as we've already said, HydroGraph has developed a new method that blows its competitors out of the water, with market-leading purity and almost perfect consistency.

The technology has the power to turn HydroGraph into the preeminent leader of graphene production.

It's called the Hyperion System, and it has the potential to change the industry.

The Hyperion System: A surprisingly simple, proprietary method to produce a supermaterial

Like many of the biggest discoveries in science, the discovery of HydroGraph's method to produce pure graphene was, initially, an accident.

A team of scientists led by Dr. Chris Sorenson at Kansas State University was working with aerosol gels. During the process, a measure of acetylene was detonated. Instantaneously, the chemical was transmuted into an incredibly fine, black substance—pure graphene. Dr. Sorenson quickly realized he had a huge discovery on his hands.

In 2017, HydroGraph obtained the worldwide, perpetual, exclusive license from Kansas State University to produce graphene through its patented detonation process.

Over the past 10 years since discovery the HydroGraph team has mastered supersonic detonation that produces consistent crystalline, pristine graphene which is part of their unique and highly-kept trade secret.

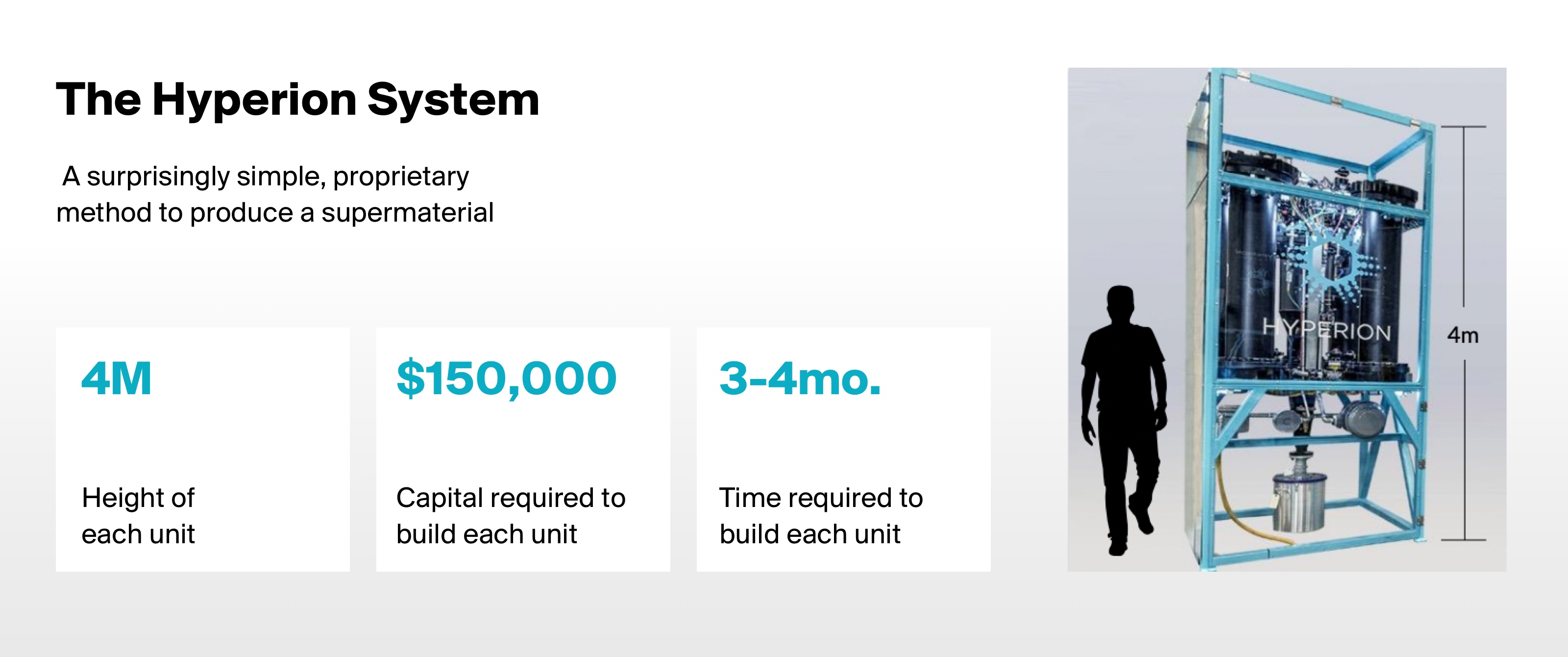

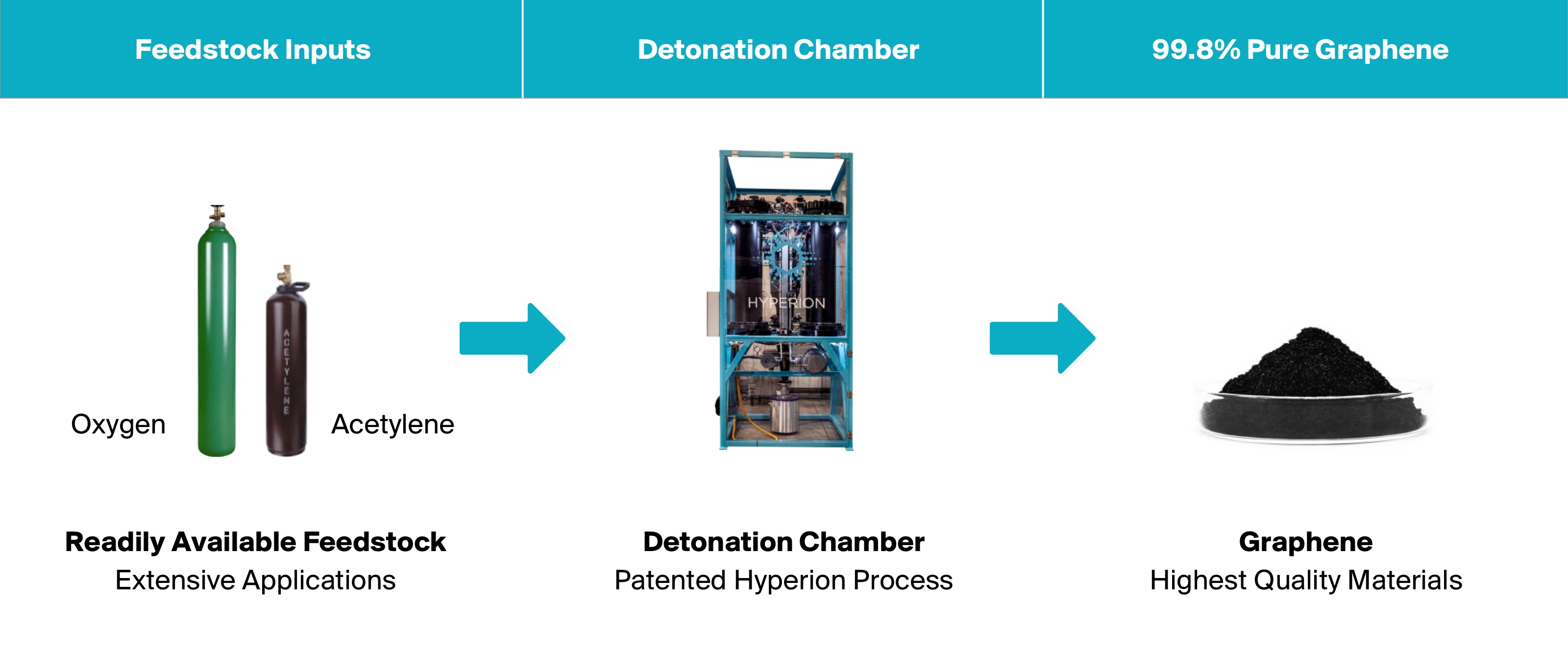

HydroGraph calls its patented system the Hyperion System, which consists of little more than some stretches of piping, detonation chambers, electrodes, valves, and a metal frame for support.

Each unit stands four metres tall, with a two-by-two-metre footprint, and requires only $150,000 in capital and four months to build.

The system uses its detonation chamber to ignite a feedstock of oxygen and acetylene, both of which are readily available anywhere in the world, with a simple spark from an electrode. Upon ignition, the mix explodes in the detonation chamber, producing 99.8% pure graphene.

This straightforward process revolutionizes production methods for graphene, producing the highest purity form of the material with virtually no environmental impact, a tiny amount of energy, and little extra cost.

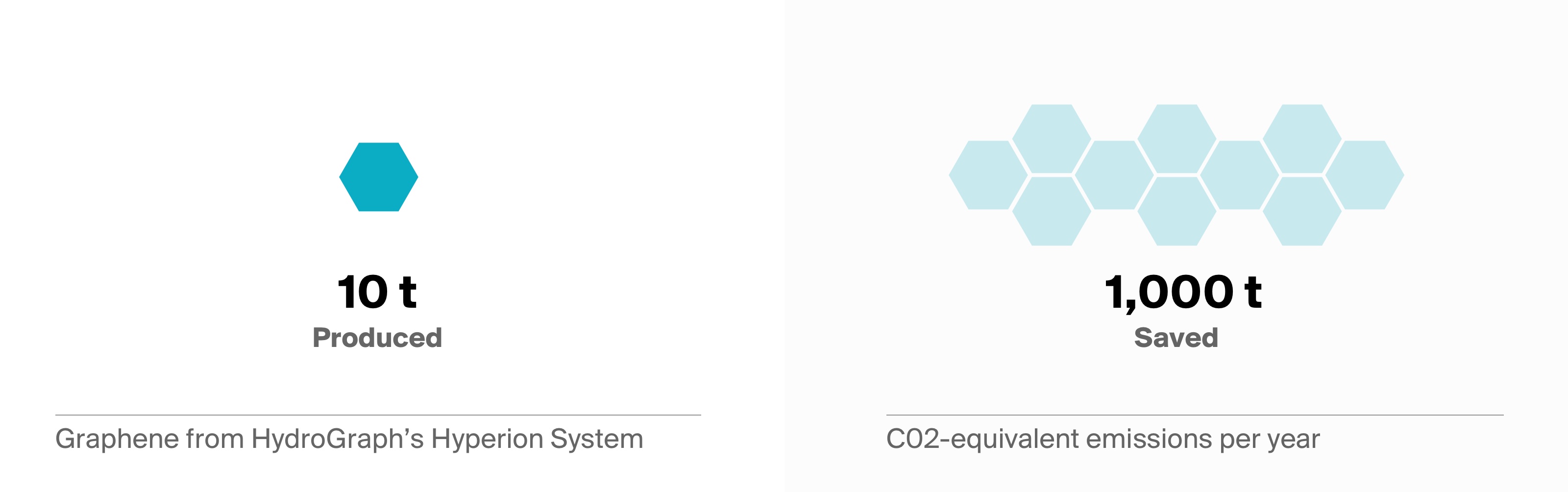

It's difficult to overstate just how much more sustainable this process is than previous, mechanical methods to produce graphene. According to HydroGraph, every 10 tonnes the Hyperion System produces can save 1,000 tonnes of CO2-equivalent emissions per year versus some conventional methods of producing graphene.

This is a key factor when so many of HydroGraph's prospective customers—in the oil and gas industries, in polymers and chemical production—are aggressively seeking ways to improve their carbon footprint and ESG initiatives and to improve their bottom-line efficiency.

Customers tell the HydroGraph team that they're excited about the purity, consistency, customizability, modularity, and sustainability of their graphene product—a package that simply hasn't existed in the market until now.

And it's not a proof of concept: the company is now producing graphene via its commercial-scale unit out of its Manhattan, Kansas facility.

A straightforward path to breakeven and beyond

With the development of the Hyperion System, most of the technical risk associated with HydroGraph's mission is behind it.

The economics behind the Hyperion System are striking. Each unit can produce $2 million worth of pure graphene—10 tonnes—annually, requiring only $150,000 in initial capital expenditure and 3 to 4 months to build the unit itself.

This means that HydroGraph can achieve breakeven within just a few months of production, highlighting it will only take a small contract to recoup their capital expenditures. Everything beyond that is profit.

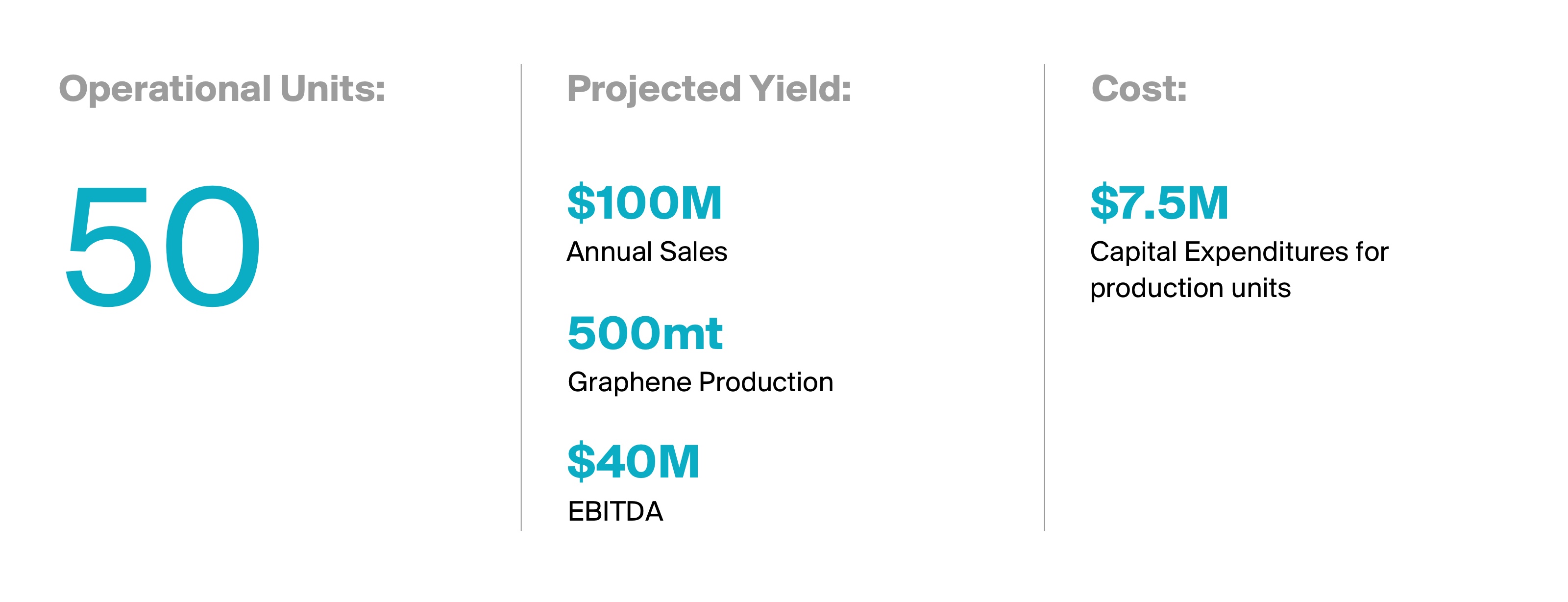

Should HydroGraph grow to 50 Hyperion System units in operation, the company could generate US$100 million annually in sales, produce 500 metric tonnes of graphene, and bring in EBITDA of over US$40 million per year—with only US$7.5 million in capital expenditures for the production units.

Those are the kinds of margins you just don't get on a venture exchange.

HydroGraph is much different from, say, mining companies, which tend to have enormous working capital costs and years and years of sunk costs before reaching profitability.

Once HydroGraph gets its first couple of customers, it will not be burning cash, even to grow. The margins are so high that it could self-fund the build-out without raising additional capital, which means no dilution for investors.

HydroGraph, unlike many of its competitors and other companies that join it on the venture exchange, is not a high-risk prospective investment play. Rather, it's a bet on the company's business development outlook.

The asset—the Hyperion System—is a completed commercial-scale unit ready to scale. It merely remains to be seen whether HydroGraph's team can secure its first couple of customers, after which its abilities will be solidified within the market.

The company hopes to announce its first big cooperation agreement by late 2023 or early 2024. We've interviewed the company's business development team, and the plan certainly seems realistic. They say that prospective customers are more than eager to receive samples and start testing, showing a serious demand for graphene of consistency and purity that only HydroGraph can offer.

Let's now dive into how that customer acquisition process works, and where the company is at in its sales efforts.

Irons in the fire and a big catalyst on the horizon

For sales, HydroGraph is most focused on the three sectors that require the high-purity graphene that the company provides: lubricants, coatings, and resins. This chunk comprises $1 billion of that projected $2.5 billion 2028 graphene market.

We don't need to get into the nitty-gritty of these three industries, but needless to say, wide access to graphene has the potential to transform these sectors.

For many months, HydroGraph has been cultivating relationships with a wide variety of potential customers.

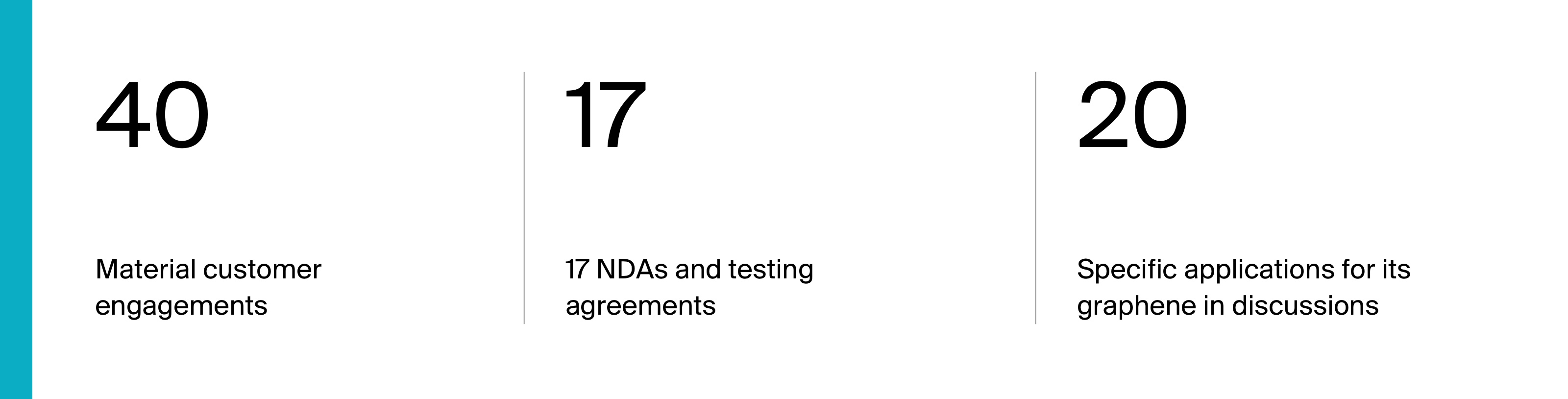

Though it hasn’t announced a commercial agreement yet, the company currently has over 40 material customer engagements, 17 NDAs and testing agreements, and over 20 different specific applications for its graphene in discussions.

It's important to note that in these industries, the customer acquisition process takes time. First, a customer needs to sample the product and confirm its quality, which takes 1-3 months. Next, the customer signs an NDA, which allows HydroGraph to share more information on applications of the tech and further testing and customization. This takes an additional 2-9 months. As previously discussed, HydroGraph has a number of these agreements already in place, with samples out and applications being tested.

Following that, if a customer is satisfied that the product is precisely what is needed for their applications, they will enter into a binding cooperation agreement, allowing them to run longevity tests and begin planning supply. This is the type of contract we're awaiting from HydroGraph right now.

If HydroGraph is able to announce a cooperation agreement, that basically indicates that the customer is closed and is now a long-term partner of HydroGraph. This leads to an ongoing supply agreement, which can last a long time: we're talking 5-10 years and beyond.

Furthermore, once such an agreement is struck, it creates a wide moat around HydroGraph's business—due to the complexities and difficulties of establishing these long-tail agreements, it is nearly impossible for a competitor to muscle in once the process has begun. Furthermore, no graphene is exactly the same, making it highly unlikely—if not near impossible—to have a clean competitor replacement to HydroGraph without a redo of that long testing regime.

As we mentioned before, HydroGraph hopes to announce its first cooperation/longevity testing agreement between late 2023 and early 2024.

If it is successful in securing these agreements, it could have a significant impact on share prices.

Such an agreement would indicate industry acceptance and adoption of HydroGraph's graphene, legitimizing its efforts and opening the doors to further partnerships.

And again, once HydroGraph has secured its first customer, a single Hyperion System unit in full operation brings the company into break-even territory.

What investors should take away from this is the fact that this is the make-or-break moment for HydroGraph. We're awaiting its catalytic moment this year.

Investment opportunities don't get much more black-and-white than that.

Further optionality to capture a growing market

Previously, we mentioned that HydroGraph has built a team to target a $1 billion subsection of the larger graphene market. This is its focus, but the company is also partnering with other companies to extend its reach into the graphene's additional $1.5 billion market as well.

The best example of this is the company's partnership with Ceylon Graphene Technologies to capture the lead acid battery market.

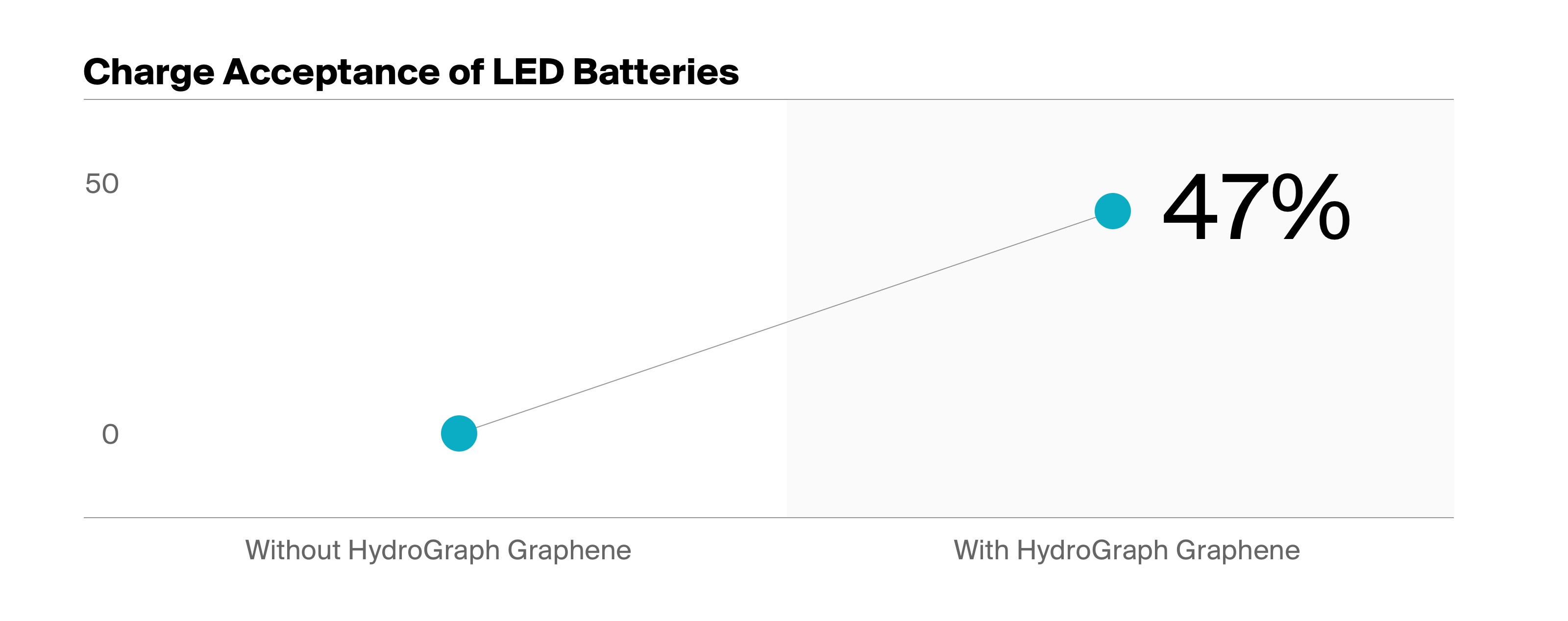

HydroGraph's graphene improves the charge acceptance of lead acid batteries by a whopping 47%.

So, Ceylon, which has the technology and application know-how for lead acid batteries, has agreed to work exclusively with HydroGraph to commercialize products for the $45 billion lead acid battery market.

In short, another graphene producer in the market is so impressed with the quality of HydroGraph's graphene that they have decided to partner with the company.

Meanwhile, HydroGraph is also pursuing R&D and application development to validate further potential uses for its graphene, any of which could have a big effect on other industries.

This gives investors optionality and exposure to even further markets outside of HydroGraph's bread-and-butter.

A team with abundant experience bringing new tech to market

HydroGraph's team is made up of people who make things happen.

The CEO is Stuart Jara, a longtime executive with 20 years of experience in the industrial, specialty chemicals, and alternative-energy sectors, with an additional 10 years of experience managing private equity portfolios and start-ups. Most recently, he raised $25 million for an early-stage H2 company at a $500 million valuation.

Its CFO is Bob Wowk, a longstanding senior financial expert with extensive experience with multinational companies. He's taken the lead on finance for over half a dozen renewable startups, increasing their valuation by a combined $500 million.

Its Chief Science Officer is Ranjith Divigalpitiya, a 25-year physicist who invented industry giant 3M's graphene-like carbon coatings, and who has contributed to 190 invention submissions, and 20 granted U.S. patents. He has authored 33 peer-reviewed papers and teaches at Western University, Canada. In any venture as technically complex as HydroGraph and graphene, it pays to have a team of scientists with a knack for bringing new ideas to fruition, and Ranjith is precisely that.

Kjirstin Bruere is President of the company, with a 15-year background in emerging technologies and portfolio management. She has experience in investor relations and currently sits as the Director of Operations for Frontline Crossings, and the Chief Operating Officer for Omada Technologies.

Dr. Chris Sorensen is the company's Vice President of Research and Development, coming to HydroGraph as a former Cortelyou-Rust University Distinguished Professor in the department of Physics at Kansas State University. He's the inventor of the company's Hyperion System, has seven patents, nearly 300 publications, and is a fellow of the American Physical Society.

Then come the two key members driving the development of HydroGraph's business.

Jennifer Carmichael is one of two directors of business development for HydroGraph, with over 13 years of experience in product development and commercialization. She is focused on the lubricants and specialty chemicals industries.

Randall Zajac is the second business development director with a long background in composites, including R&D, engineering, and business development. He is focused on business development in resins, composites, and coatings.

The takeaway here is that both Randall and Jennifer come to HydroGraph with abundant, specific experience in the industries to which HydroGraph aims to sell. This gives them the lay of the land in the complex industrial landscape and furthers our confidence that they can secure the contracts that will bring HydroGraph into its next phase.

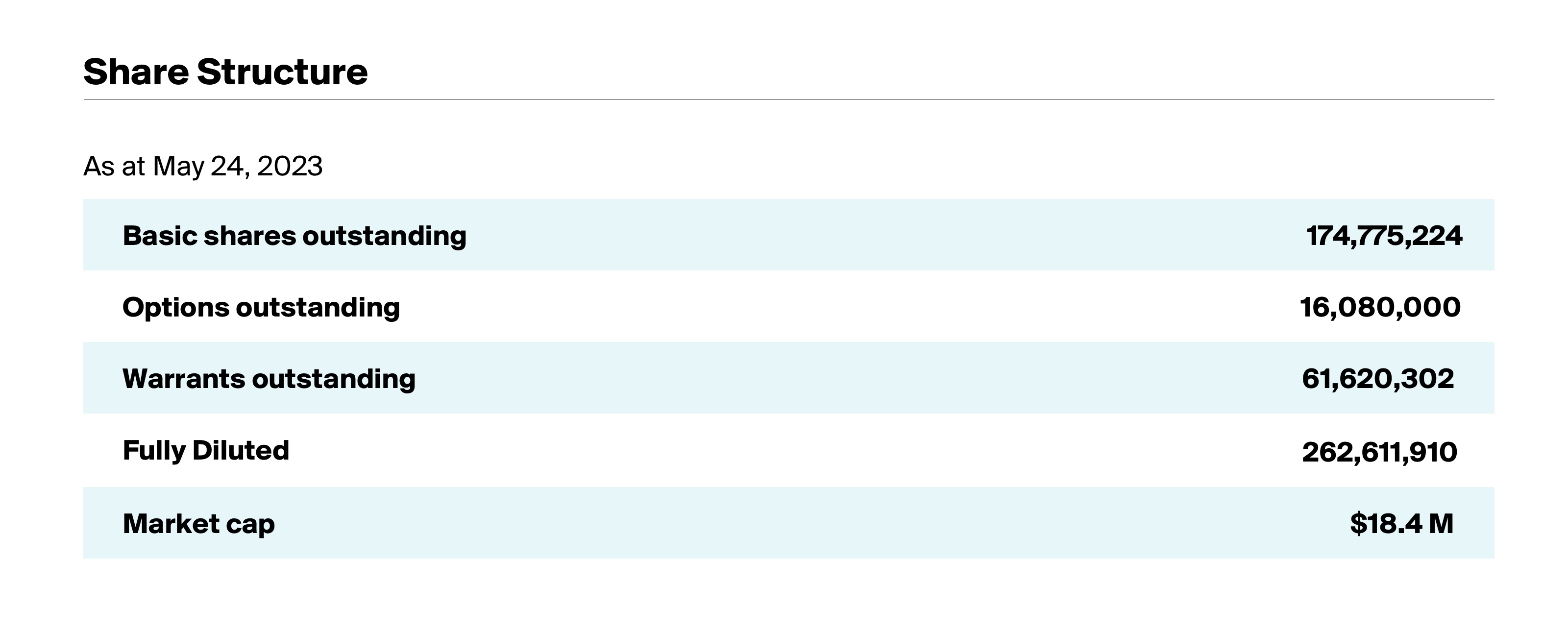

An attractive share structure with C-suite skin in the game

Management has contributed about 13% of the total public cash raised to date—the kind of skin in the game we believe essential to any potential investment.

A short-term opportunity with a long tail

We believe that now is the ideal moment to consider investing in HydroGraph, as we await its potential first customer announcement targeted between late 2023 and mid-2024.

While we certainly can't predict the future, if such an announcement is made, the stock could quickly price in the added value of its proven product—by then, investors may have missed the party.

That said, an investment in HydroGraph is more than a short-term play: once the company begins to capture market share, its superior product and abundant potential applications for its technology give it a long, long way to expand.

This is exactly the kind of opportunity our readers love. Early-stage access with the potential for transformative long-term results.

Don't hesitate: do your due diligence today.

To learn more about HydroGraph Clean Power Inc. (CSE: HG; OTCQB: HGCPF)

Disclaimer: The service and the contents are provided by the sender and other information providers on an "as is" basis. The sender and any and all other information providers expressly disclaim any and all warranties, express or implied any information herein or on PrivatePlacements.com.

PrivatePlacements.com and its owner and its owner's directors, employees, consultants, contractors, agents, and the like ("Representatives"), do not give any tax or investment advice; and do not advocate the purchase or sale of any security or investment. Contents are intended as general information. None of the contents constitutes an: (1) offer to sell or the solicitation of an offer to buy by Blender Media and/or its representatives any security or other investment; (2) offer by PrivatePlacements.com or its owner and/or their representatives to provide investment services of any kind; and/or (3) invitation, inducement, or encouragement by Blender Media and/or its representatives to any person to make any kind of investment decision. You should not rely on the content for investment or trading purposes. Securities or other investments referred to in any of the contents may not be suitable for you, and you should not make any kind of investment decision in relation to them without first obtaining independent investment advice from a person authorized to give it. All communications by PrivatePlacements.com are subject to its terms of use and disclaimer, which can be viewed here and here.