Ground-Floor Access to a Massive Mining District, Backed by a Dream Team of Regional Gold Mining Experts

Ground-Floor Access to a Massive Mining District, Backed by a Dream Team of Regional Gold Mining Experts

Kainantu Resources Ltd. (TSX-V: KRL)

The story at a glance:

- Excellent assets in a proven region: A focus on two projects in Papua New Guinea with close proximity to tremendously successful mines.

- An uncommonly experienced management team: With leaders hailing from some of the most successful companies in the Asia-Pacific, and a deep understanding of the intricacies of PNG mining.

- Early-stage potential: A stock that just recently began trading on the TSX-V whose true value investors haven't caught on to yet.

- Ample cash on hand: Following a recent $4.1 million financing, the company is cashed up for its 2021 plans.

- Skin in the game: Strong insider ownership, yet still with the liquidity needed for retail investors to get in.

Kainantu Resources is a well funded junior gold exploration company investing heavily in projects in Papua New Guinea, mere kilometres away from one of the most successful new mines of the past ten years.

Experts have long seen PNG as the host to incredibly promising gold mineralization, but larger operators have historically stumbled on the complex sociopolitical intricacies of the region, leaving significant upside in the ground.

Luckily, Kainantu Resources brings the expertise of some of the foremost resource and exploration leaders of the Asia-Pacific Region, responsible for a US$600 million takeover and the creation of $980 million in enterprise value.

This is a team with a history of wins in the Asia-Pacific region, turning their attention to a deeply promising project portfolio with clear similarities to recent runaway success K92 Mining.

With strong fundamentals leading gold investment in 2021 and exploration underway, it's the ideal moment to learn more about Kainantu Resources (TSX-V: KRL).

Read on for a full breakdown of the company, and discover why we're so excited about its future prospects.

We analyze every exploration stock with our five M's of mining success:

Macro: Is there a genuinely catalytic trend underpinning the commodity? Is it a good time to invest?

Mines: Is the company's project in an area with historical precious metals success? What has the company found so far? What does the company plan to do differently from the deposit's previous owners?

Movement: What will cause price movement for shares in the company in the coming months or years? Where do your returns come in?

Money: What is the company's share structure? How much cash does it have on hand?

Management: Does the management team behind a company have what it takes to bring a mine into production? Do they have a history of serial success? Do they have concrete experience in the specific field in which they now operate?

Macro: In an uncertain market, gold remains one of today's most exciting investment stories.

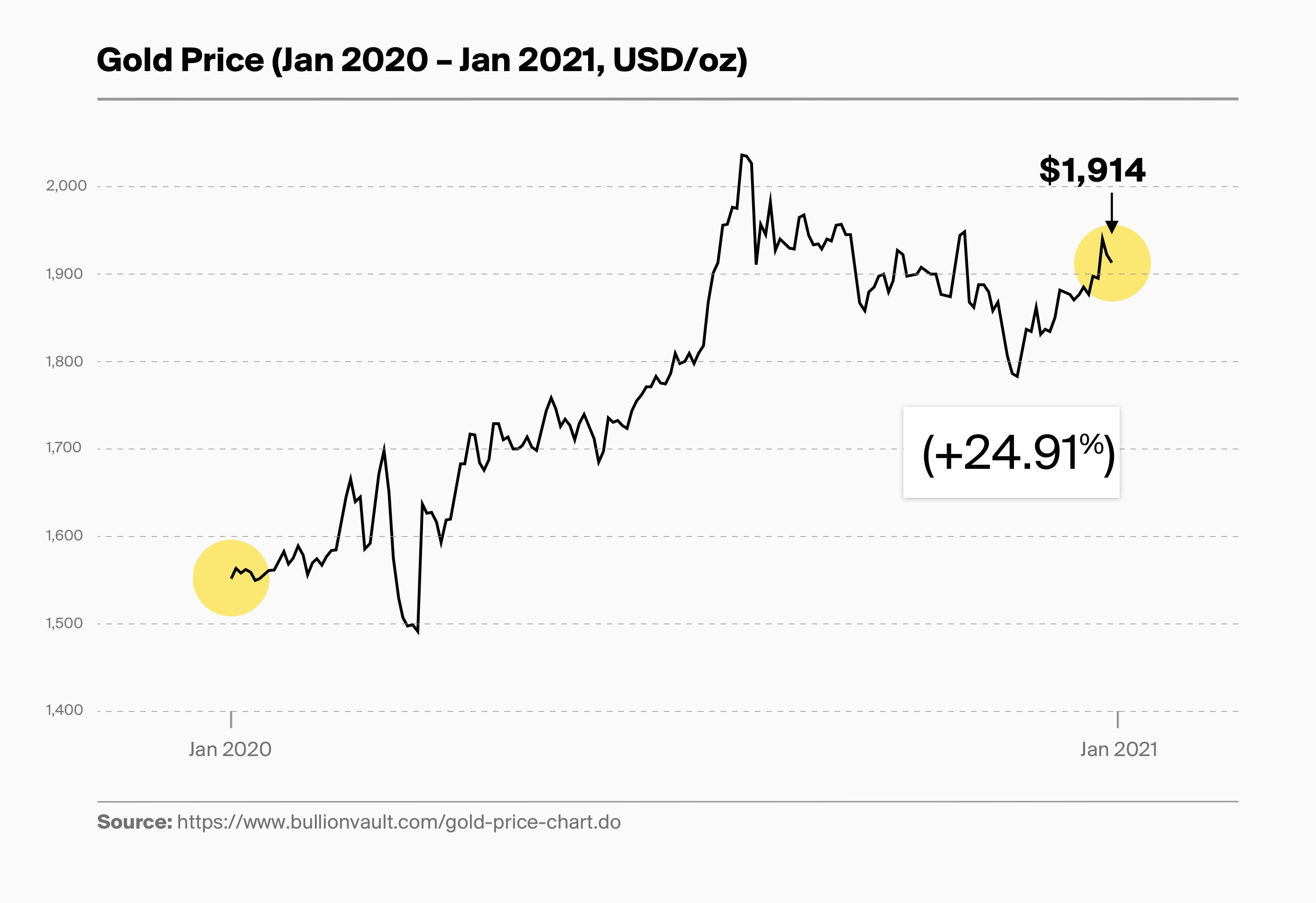

Following the biggest bull run in the history of gold, the US spot price for the yellow metal surged to its highest all-time peak on Aug. 6, 2020, at $2,069.03 an ounce.1

Propelled by the COVID-19 pandemic and the recent US election, the price of the precious metal rose 24.91% in 2020, driving a flood of investment into bullion and mining stocks.

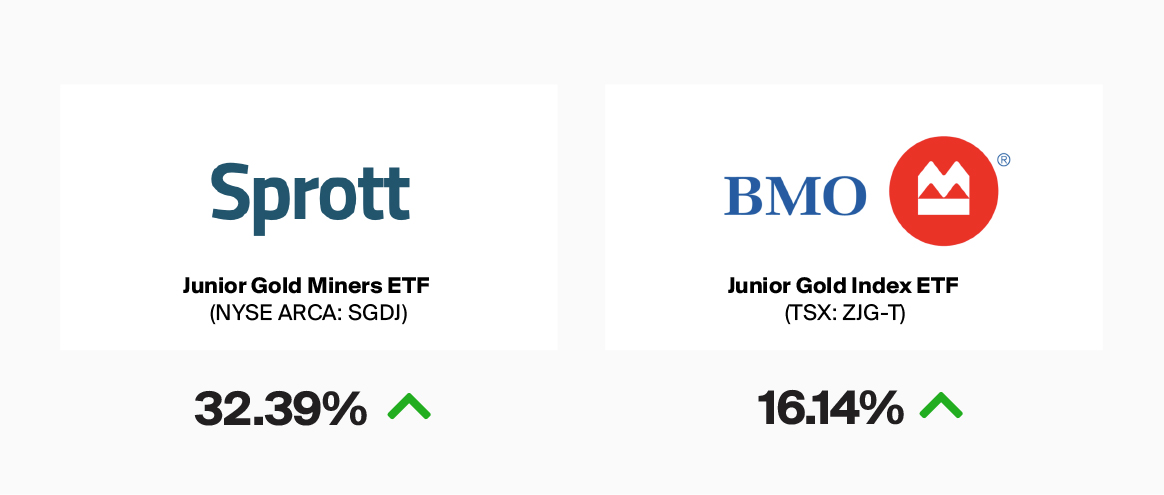

Junior miners thrived in particular, driving gains throughout the sector. ETFs like the Sprott Junior Gold Miners ETF (NYSE ARCA: SGDJ) and the BMO Junior Gold Index ETF (TSX: ZJG-T) enjoyed returns of 32.39% and 16.14% respectively, as money flooded into the industry.2,3

But amid the gold fever, even as numerous well-managed, early-stage exploration companies with excellent assets finally got their moment in the sun, other less-promising gold stocks grew overvalued and too expensive to justify.

Starting in mid-November, we saw a steep contraction to the price of gold, as the yellow metal dropped below resistance levels to under $1,800 an ounce.

However, as worrying as the drop may be to today's gold investor, the outlook remains strong for precious metals.

In the coming weeks, we will see many overvalued gold stocks return to reasonable levels as the hype settles—meaning it will be the perfect time for investors to double down or get involved.

Many experts are saying that the current drop in gold lacks any firm fundamental explanation, and that the following years suggest the yellow metal may continue to smash records.

In fact, Bloomberg Intelligence's December outlook says that "gold is poised to extend its uptrend" well into 2021, with the current price contraction simply part of a larger rise. "Dipping into support layers toward the end of November should provide a foundation for further price gains. Backing up into its upward sloping 50-week moving average toward the end of 2020 should provide the gold bull market a relative advantage in 2021." 4

"The metal may be less supported by rising stock-market volatility as in 2018-20, but seemingly unstoppable trends in negatively yielding debt, quantitative easing (QE) and rising debt-to-GDP provide firm foundations for the store of value," analyst Mike McGlone said in the report.

The macro trends that brought gold to over $2,000 an ounce remain: Governments continue to scramble to provide relief to a world economy battered by COVID-19, bond yields continue to disappoint, and everybody's favorite "safe haven" asset is more attractive than ever.

But as always, the best way to generate tremendous returns from a strong gold market isn't buying bullion or shares of well-established international miners—it's investing in the junior gold space, where make-or-break assets transform overnight into sources of genuinely life-changing wealth.

And in that arena, Kainantu Resources (TSX-V: KRL) is one of the best.

Mines: Untapped assets in a globally-recognized mining district

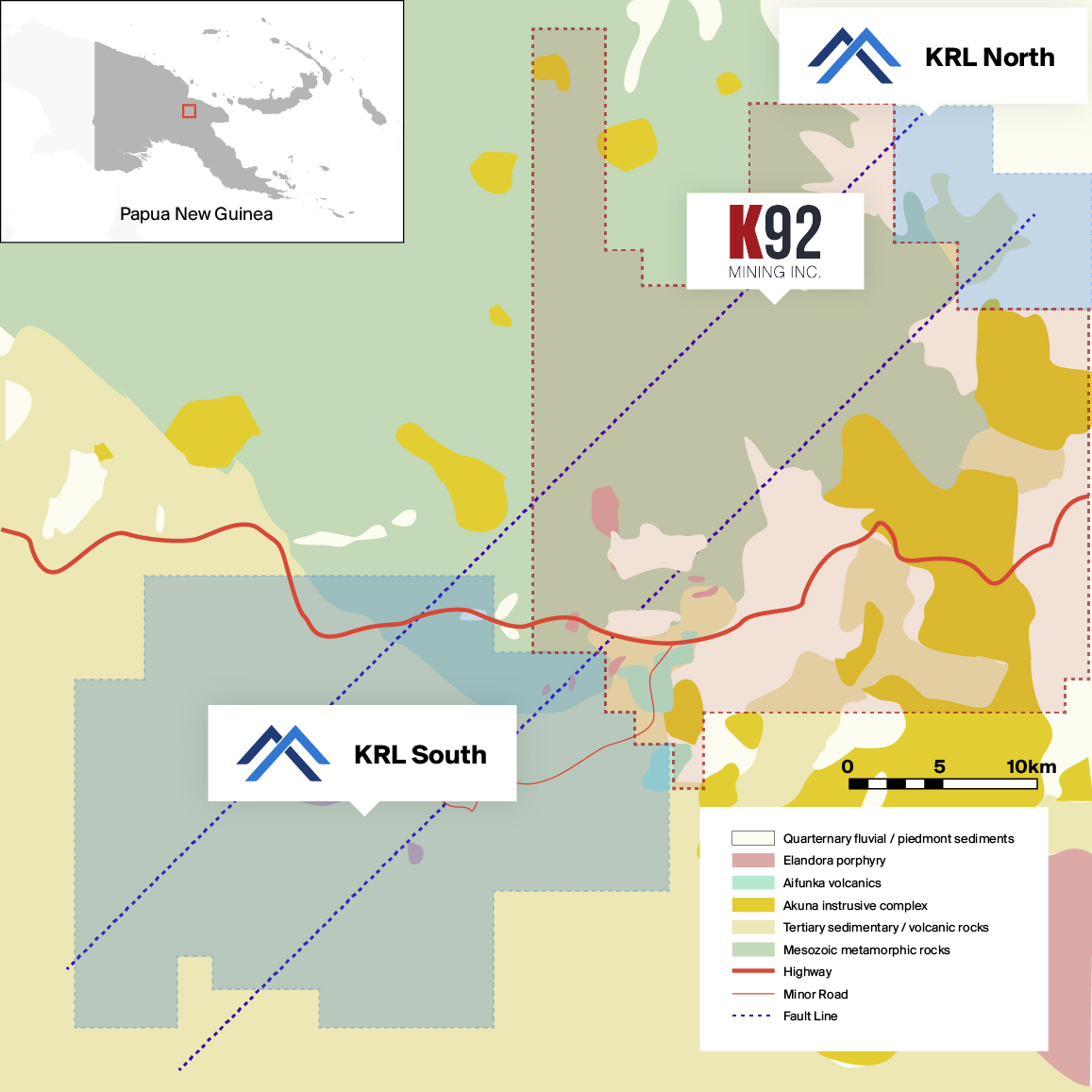

Kainantu Resources is dedicated to uncovering upside on its two projects, both located in a highly-prospective region of Papua New Guinea.

Papua New Guinea is a country well-known for its resource and mining partnerships, with deep ties to minerals, oil, and gas extraction firms including Exxon-Mobil, Newcrest Mining (TSX: NCM), Barrick Gold Corp. (TSX: ABX), Vale (NYSE: VALE), and Rio Tinto Ltd. (ASX: RIO).

In fact, 86% of PNG's total export revenue came from these industries in 2018.

The area is well-endowed with gold mineralization sitting on the Papual Mobile Belt, host to a few truly world-class mines:

- The Kainantu mine, operated by K92 Mining Inc. (TSX-V: KNT), which contains an estimated 630,000 ounces of gold measured and indicated and 2.58 million ounces inferred, remarkably low all-in sustaining costs, and the fourth-highest gold production head grade in the world, averaging 17 grams of gold per tonne in 2020

- The Lihir mine, acquired by Newcrest Mining for $9 billion in 2010, which produced 933,000 ounces of gold in fiscal 2019 5

- The Porgera mine, a joint venture between Barrick Gold Corp. (TSX: ABX) and Zijin Mining, which produced 284,000 ounces of gold in 2019 6

Just across the border in Indonesia lies the Grasberg mine, the biggest gold mine in the world, and the world's second-biggest copper mine. The mine has produced over 1.06 million ounces of gold thus far.

But as the name suggests, K92's mine is especially interesting in the context of Kainantu Resources, located mere kilometres away from the latter company's two projects: KRL South and KRL North.

Since K92 began operating the Kainantu mine in October 2016, shares of the company have jumped more than 483% at the time of writing, closing out 2020 at $7.61 per share, with a $1.76 billion market cap.

What's more, Canaccord analysts have pegged K92 with a price target of $12.50 per share. If K92 can realize this potential, that would give it a market cap of $2.73 billion.

And Kainantu Resources' projects are both remarkably similar to K92's mine, both located on the world-renowned Kainantu faultline, the same trend that has borne such tremendous fruit for K92.

All this is just to say that Kainantu Resources (TSX-V: KRL) is exploring ground that may have the absolutely incredible takeoff potential of a K92.

When searching for an early-stage gold play, it pays to follow connections like these. And they don't stop there.

But more on that later. For now, let's dig into both of these projects to see exactly what Kainantu is working with.

KRL South

KRL South encompasses 597 square kilometres in the Eastern Highlands province of PNG, about 30 kilometres away from K92's operating mine.

The project sits on a large, underexplored gold field, bisected by the aforementioned Kainantu fault line, a geological structure that is also host to K92's flagship project.

This explains why KRL South's mineralization so closely mirrors that of K92's mine, with multiple epithermal vein systems, several skarn deposits and porphyry mineralization to the south and east.

Each of these anomalies are worth exploring, but Kainantu Resources has identified four recently uncovered "ring features"—geologic structures which can indicate shallow pockets of gold in igneous stone—on the property.

These rings have quickly become top priority targets for the company, and form the crux of its planned drill program, with six prospects identified and soil sampling underway.

At one of these ring features, Tirokave, the company has already observed occurrences of visible gold in pan samples.

In exploration work conducted in 2019 and 2020, Kainantu collected over 2500 samples, which consistently reaffirmed the potential of the property—and its potential similarities to K92's hugely successful mine.

Now, the company is undertaking a much more extensive sampling campaign to uncover targets at Tirokave, aiming to lead an upcoming drill program.

KRL North

At just 129 square kilometres, KRL North is a smaller property, but it is located adjacent to K92's operating gold mine, and essentially shares that project's mineralization.

The project sits on the central Bilimoia mineral field, which is key to K92's high-grade mine.

With limited exploration on the property to date, there isn't too much to say on KRL North just yet, except that its proximity and similarity to several high-grade systems makes it a prime target.

Take, for example, K92's Maniape and Arakompa prospects, 2-4 kilometres away from KRL North. Previous operators identified a total resource of 1.36 million ounces of gold in the area back in the 90s, with grades of up to 9.0 grams of gold per tonne (g/t Au).

Kainantu Resources (TSX-V: KRL) has planned a field mapping and sampling program for KRL North in 2021.

If it is able to uncover a system at KRL North with grades anywhere near K92's projects—again, just kilometres away—there's little doubt the news would significantly move shares.

It's worth repeating that K92's projects propelled its stock from just $1.40 in September 2016 to over $8.00 per share at the time of writing.

That is to say: both KRL North and South are in good company on the proven Kainantu faultline.

With these two projects in mind, Kainantu Resources is more than a proximity play. It offers early-stage access to a remarkable gold district.

However, a savvy investor may wonder why these projects weren't snapped up by K92 in the first place.

The answer is one of timing: the Kainantu Resources team identified and acquired these tenements right as K92 was laser-focused on developing its budding mine.

However, Kainantu did have some competition for KRL North and South, in the form of a state-sponsored Chinese company which had been mapping for prospects in PNG at the time.

After the Kainantu team's previous natural gas success with APEV / Asia-Pacific Energy Ventures (more on that later), they were looking for further upside in the PNG region.

To find it, the Kainantu team engaged directly with the PNG mineral resource authority and APEV to zero in on promising exploration targets in close proximity to other successful mines.

KRL was particularly interested in investing in a property in which they could make a difference resolving persistent social licensing issues through their high standing in the PNG community.

Working with PNG and APEV experts, Kainantu pinpointed KRL North and South.

Already, a Chinese company had expressed a keen interest in the tenements, following extensive field work in the area.

Luckily, just as the Chinese company moved to acquire, Kainantu got their application in first, sealing the deal mere hours ahead of the competition—in large part due to Kainantu's respected standing with key PNG stakeholders, as well as their reputation for delivering on commitments.

As a result, the team snagged a land package with deep structural similarities to K92 and with similar takeoff potential.

It was an opportunity the Kainantu Resources team was perfectly positioned to take, and one for which they're preparing to reap the rewards.

Movement: What's next for Kainantu Resources? Which catalysts could generate a meaningful return?

As with all junior mining companies, Kainantu Resources will succeed or fail on the strength of its projects.

As previously mentioned, since K92 Mining, the company in close proximity to Kainantu Resources' projects and on the same mineral belt, began exploring its flagship project, shares have jumped over 483.6%, turning that company into a powerhouse with a $1.76 billion market cap.

And again, if K92 is able to achieve Canaccord's price target of $12.50 per share, it will have a market cap of $2.7 billion.

K92's Kainantu mine was the fourth highest-grade mine in the world in 2020, with an average head grade of 17.3 g/t Au, and all-in sustaining costs of just $770/oz in 2020—remarkably low expenditures for a mine with such potential.

All of this is a testament to the ground that Kainantu Resources is working with.

If Kainantu (TSX-V: KRL) is able to replicate even a fraction of this success just kilometres away, we may be looking at the biggest PNG investment play of the decade.

KRL North and South are both strong enough to invest in Kainantu today, but their true value won't be known until we get some sampling and drill results. We can expect this program to accelerate throughout 2021.

Following Kainantu's recent private placement, we can be confident the company is cashed up for a targeted field program in 2021, which will lay the groundwork for an eventual drill program, and finally, a full initial resource estimate.

With plans to initiate this program soon, we can expect ample newsflow in the coming months—another key factor when investing in junior miners.

Each release has the potential to inch KRL toward becoming another runaway mining success, a company that rises to dominate the world-class Asia-Pacific market.

And if resource analysts are to be believed, we can expect the stock to receive support as gold prices bounce back and beyond their record-breaking 2020 peaks.

Money: A fresh-faced and deeply undervalued stock, with encouraging insider ownership and nowhere to go but up.

The key to making enormous profits in the mining sector is to get in early on an undervalued company just before it confirms the true value of its projects and shares take off.

As we've said, your first few questions should always include "Am I investing in a serially successful team?" and "What about this company's projects makes them uniquely attractive?" But of course, once you've squared those away, the question becomes "Is there still time to join the party?"

And in Kainantu's case, there couldn't be a better time.

Kainantu Resources (TSX-V: KRL) just began trading on the Toronto Stock Venture Exchange on Dec. 8, following the closing of an over-subscribed $4.1 million private placement.

The financing was subscribed by a combination of insiders with serious skin in the game and well-informed mining players and funds, including Haywood, PI Financial, and Canaccord Genuity.

The stock opened at 20 cents, and rose all the way up to 35 cents in its first day on the TSX-V. Now, with only 45 million shares issued and a market cap of just CA$13 million, this is one opportunity loaded with potential upside.

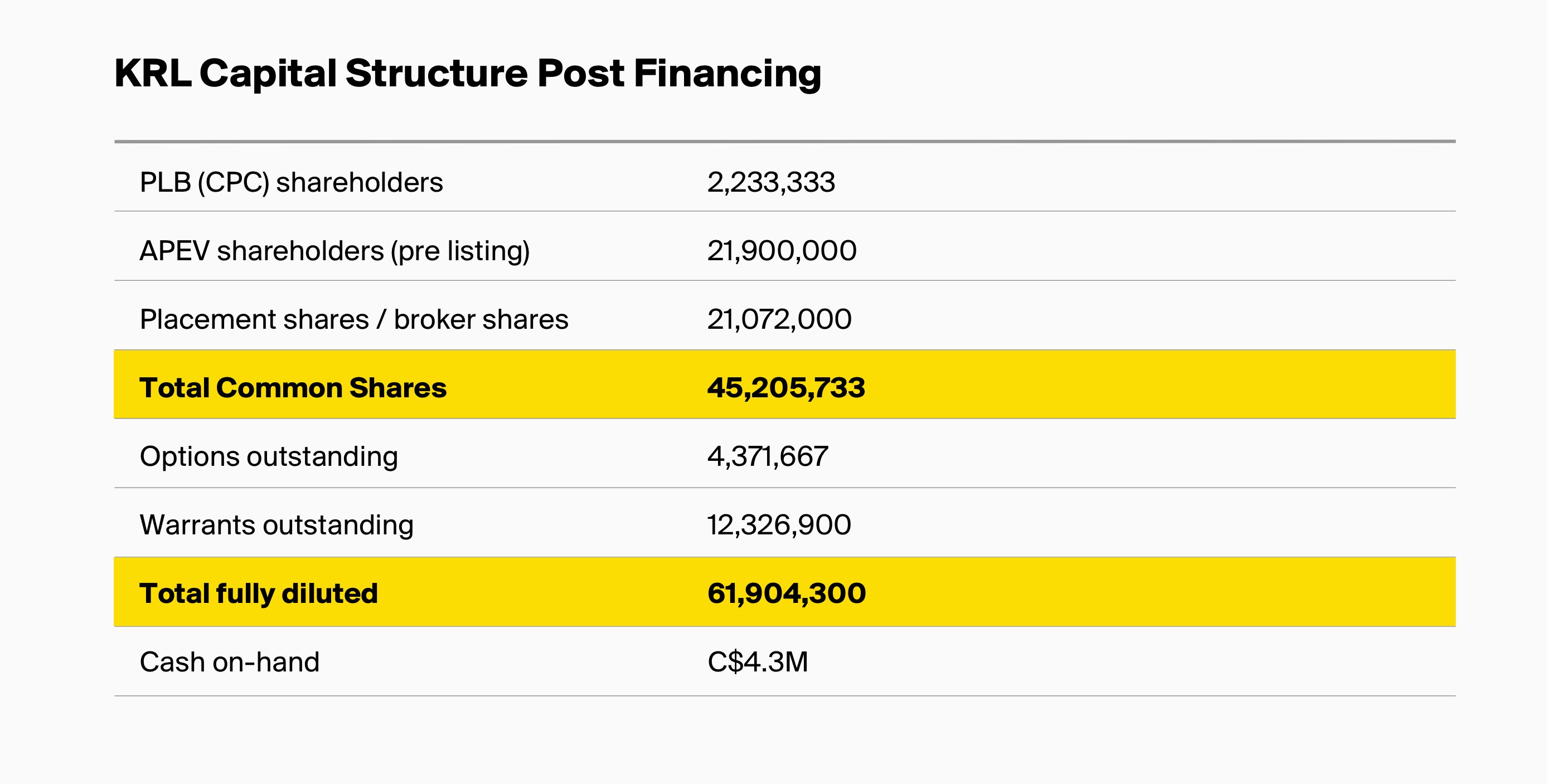

Here's the quick breakdown of the company's cap structure as of Dec. 4, 2020:

Through all this, it's important to note how underpriced Kainantu is when compared to its peers.

Take, for instance, K92 Mining. Kainantu Resources' projects are mere kilometres away from K92's operations—but K92 has a market cap of $1.53 billion.

K92's value is already priced-in to its shares, whereas Kainantu is just getting started.

Kainantu is a value investor's dream, and with big moves on the way, the time to get involved is now.

Management: Resource specialists with extensive experience navigating the intricacies of Papua New Guinea.

KRL's management team hails from some of the most successful ventures in the Asia-Pacific region, and Papua New Guinea specifically, over the past twenty years, including Oceanagold, which today has a market cap of $1.64 billion, and Archipelago Resources, which was taken over in 2014 for US$600 million at a 40% premium to its then-market price.

Matthew Salthouse, Kainantu's CEO, was a key member of the team that drove Oceanagold's enterprise value increase from US$20 million to US$1 billion from 2007-2011.

And he and Kainantu Chairman Marcus Engelbrecth were both instrumental in Archipelago's tremendous success and its eventual takeover bid.

Whenever you're considering investing in a mining company, it's important to seek out a team with successes like these in their past.

But in Kainantu's case, management's history in the region is especially encouraging, because while Papua New Guinea is highly prospective, it can also be tricky politically.

For example, this year has seen Barrick in a high-visibility court battle with the PNG government to maintain control of the Porgera mine, as the country plans to shift the mining lease to the state's national mining company following years of conflict with local citizens.

It's good, then, that Kainantu's team has more experience than almost anyone navigating the complex sociopolitical intricacies of the area, including receiving enthusiastic buy-in from Papua New Guinean stakeholders.

All members of the team have worked in PNG and/or other complex developing countries in Asia-Pacific and understand what needs to be done to get desired outcomes.

In addition, the team is supported in the country by APEV / Asia-Pacific Energy Ventures, the first independent EPC firm to build a gas power plant in the PNG region; and a business which is highly regarded by key government and institutional stakeholders.

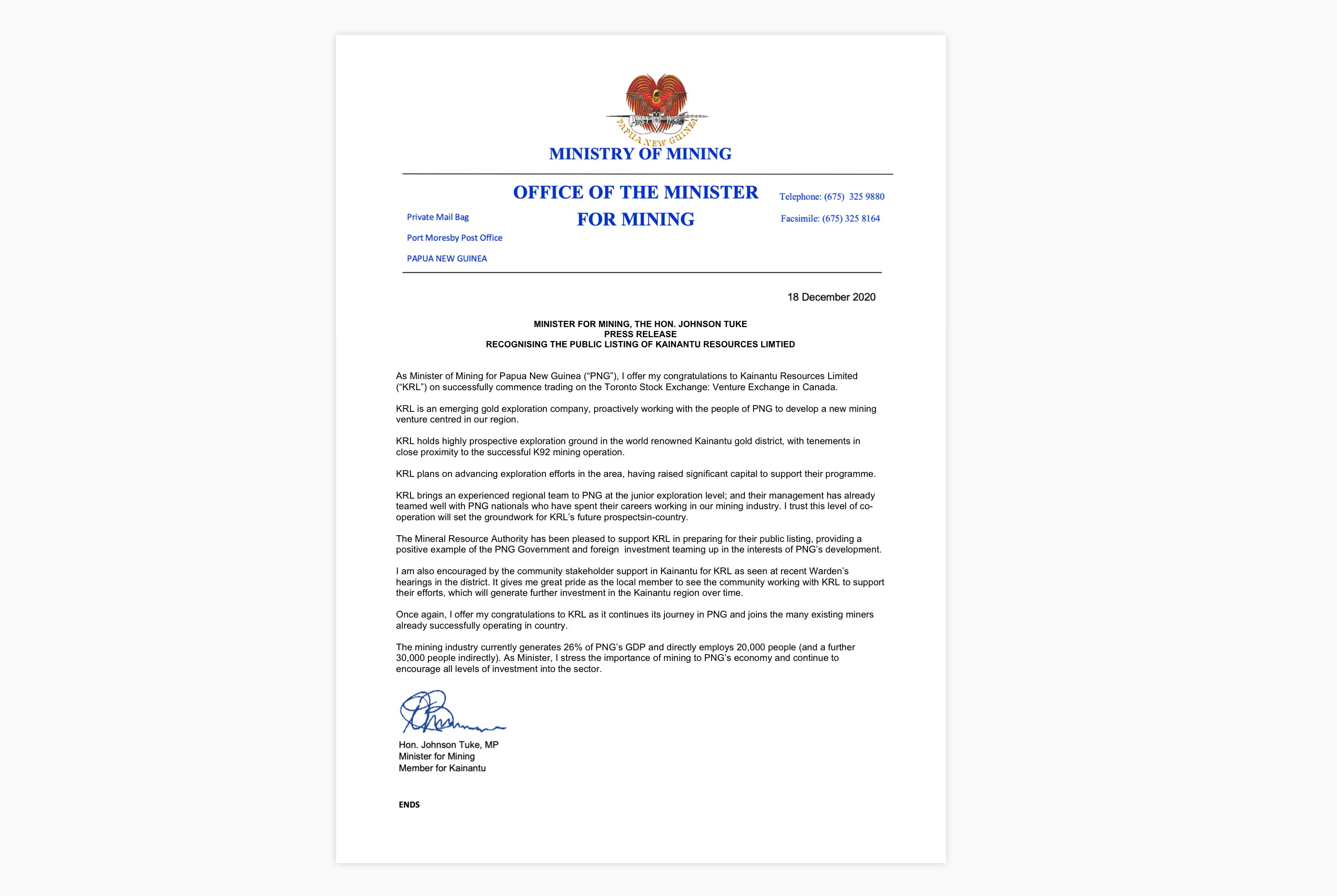

Recently, Kainantu Resources (TSX-V: KRL) even received public support from Papua New Guinea Mining Minister Johnson Tuke.

In a press release from Dec. 18, 2020, Mr. Tuke congratulated KRL on its recent joining of the TSX-V, saying that the KRL "management has already teamed well with PNG nationals who have spent their careers working in our mining industry," and that he trusted that "this level of co-operation will set the groundwork for KRL’s future prospects in-country."

"I am encouraged by the community stakeholder support in Kainantu for KRL as seen at recent warden's hearings in the district," said Mr. Tuke. "It gives me great pride as the local member to see the community working with KRL to support their efforts, which will generate further investment in the Kainantu region over time."

KRL'S listing on the TSX-V was recently front and center in the business section of the government's National Institute of Standards and Industrial Technology newspaper, reiterating the support of Mr. Tuke, further bolstering the company's local and international clout.

Support like this, from some of the highest offices in the land, indicates that Kainantu may succeed where others before it have failed. In a place like Papua New Guinea, local support of the lack thereof can make or break a company's fortunes—and it's clear that KRL already has a remarkably strong foundation.

KRL management is equipped with not only a keen understanding of the complexities of the PNG, but a genuine investment in its communities, free from all the sociopolitical baggage that other large operators have been saddled with over the years.

Matthew Salthouse: Chief Executive Officer and Director

A former Oceanagold executive with enormous social licensing savvy.

A mining executive with over 25 years of experience in the field, Matthew Salthouse was a key member of the Oceanagold team that saw the company's enterprise value increase from US$20 million to US$1 billion from 2007-2011.

In particular, Mr. Salthouse was instrumental in bringing the company's Dipidio project in the Philippines from care and maintenance into the development phase while he was Country President. Prior to Mr. Salthouse taking on that role, the project was poorly regarded, mired in conflict with local indigenous communities and a concession dispute with the government.

Mr. Salthouse oversaw the resolution of conflicts with the locals, the government, and land owners, each key ingredients leading to the ultimate commissioning of the Dipidio mine, which has formed the basis for Oceanagold's success story in recent years.

Not only that, Mr. Salthouse was the lead executive responsible for executing the raise of $200 million used in the construction of the Didipio mine.

Mr. Salthouse then joined Southeast-Asia-focused Archipelago Resources as President of Corporate Strategy. As a senior executive, he was part of the team that defined a resource of three million gold-equivalent ounces at the Toka Tindung project in Indonesia, and moved that project into production of 250,000 gold-equivalent ounces a year at remarkably low cash costs for the industry.

Later, he was instrumental in achieving a 40% premium for shareholders when an Indonesian investment company brought a takeover bid, valuing Archipelago with an enterprise value of US$600 million —a serious exit.

With multiple Asia Pacific gold mines under his belt and an incredible wealth of social licensing experience, Mr. Salthouse will undoubtedly be a highly effective leader in executing Kainantu’s strategy.

Marcus Engelbrecht: Chairman and Director

A high-ranking mining executive with over three decades working in developing countries.

Also hailing from Oceanagold and Archipelago Resources, Marcus Engelbrecht is a Canadian mining executive with over 37 years of experience.

Mr. Engelbrecht's first claim to fame was his role as the CFO of BHP Diamonds and Specialty Products, overseeing operations scattered across six continents.

Later, he joined OceanaGold as CFO. Like Mr. Salthouse, he was a vital force for the company's stunning recovery and eventual success. As the CEO of Archipelago, he took the company from construction all the way through to production.

Another seasoned executive with deep experience bringing projects in countries with challenging sociopolitical environments into production, Mr. Engelbrecht is precisely the kind of Chairman a company like Kanaintu needs in its corner.

Geoff Lawrence: Director

Former energy CEO with a deep operational understanding of Papua New Guinea.

Geoff Lawrence is an Australian executive who has served as the CEO of APEV / Asia-Pacific Energy Ventures and its subsidiary, Pacific Energy Consulting (PEC), for over seven years.

There, he has overseen tremendous advancement in infrastructure and energy services throughout the region, especially at Papua New Guinea, at which his company recently opened a 45-megawatt, gas-fired power station, in Port Moresby.

Mr. Lawrence is the definition of a "boots on the ground" executive, spending almost all of his time personally building community relationships and overseeing operations with PEC's 265+ staff in PNG.

With over more than 18 years working in Papua New Guinea and Southeast Asia, Mr. Lawrence has built an enormous network of key government and corporate contacts in PNG, from Prime Minister James Mirape to Johnson Tuke, the current Minister for Mining—whose electoral district happens to include Kainantu Resource's projects.

Doing business can be complicated in a region like the PNG, but with an individual with highly specified local expertise like Geoff Lawrence involved, no obstacle can stand in KRL's way.

It's one of the reasons Kainantu has been able to continue safely working in the PNG during COVID-19, when so many of its peers have completely suspended operations.

All in all, it's an uncommonly strong investment thesis for such an early-stage junior miner, and an extremely compelling play whether you're primarily interested in the Asia-Pacific region or simply on the hunt for experienced, thorough management teams in the sector.

Really, though, any investor interested in making life-changing gains through gold investment should have their eye on Kainantu Resources (TSX-V: KRL).

It is absolutely one of the top companies to watch in 2021, and we'll be making sure to keep our readers informed on its story as it develops.

In the meantime, we'd encourage you to dig deeper on Kainantu.

Learn more about Kainantu Resources (TSX-V: KRL):

Access Kainantu's Investor Package

Subscribe to Kainantu's investor newsletter to stay abreast of updates

AND

View the company's investor presentation and full breakdown below

Happy investing,

The PrivatePlacements.com Team

Sources:

1 BullionVault, Link.

2 BMO Junior Gold Index ETF, numbers taken from Jan. 1 to Nov. 30. Link.

3 Sprott Junior Gold Miners ETF, numbers taken from Jan. 1 to Nov. 30. Link.

4 "Risk in gold is 'limited': Prices still on track towards $2,100 in 2021 - Bloomberg Intelligence," Kitco, Nov. 30, 2020. Link.

5 "Lihir Gold Mine, Lihir Island, Papua New Guinea," Mining Technology. Link.

6 "Porgera," Barrick Gold Corp. Link.

Full Disclosure: Kainantu Resources Ltd. is a paid sponsor of PrivatePlacements.com. To learn more about Kainantu Resources Ltd., you can visit its website at www.kainanturesources.com and review its annual information and public disclosure documents on www.sedar.com.

Disclaimer: The service and the contents are provided by the sender and other information providers on an "as is" basis. The sender and any and all other information providers expressly disclaim any and all warranties, express or implied any information herein or on PrivatePlacements.com.

PrivatePlacements.com and its and its owner and its owner's directors, employees, consultants, contractors, agents, and the like ("Representatives"), do not give any tax or investment advice; and do not advocate the purchase or sale of any security or investment. Contents are intended as general information. None of the contents constitutes an: (1) offer to sell or the solicitation of an offer to buy by Blender Media and/or its representatives any security or other investment; (2) offer by PrivatePlacements.com or its owner and/or their representatives to provide investment services of any kind; and/or (3) invitation, inducement, or encouragement by Blender Media and/or its representatives to any person to make any kind of investment decision. You should not rely on the content for investment or trading purposes. Securities or other investments referred to in any of the contents may not be suitable for you, and you should not make any kind of investment decision in relation to them without first obtaining independent investment advice from a person authorized to give it. All communications by PrivatePlacements.com are subject to its terms of use and disclaimer, which can be viewed here and here.